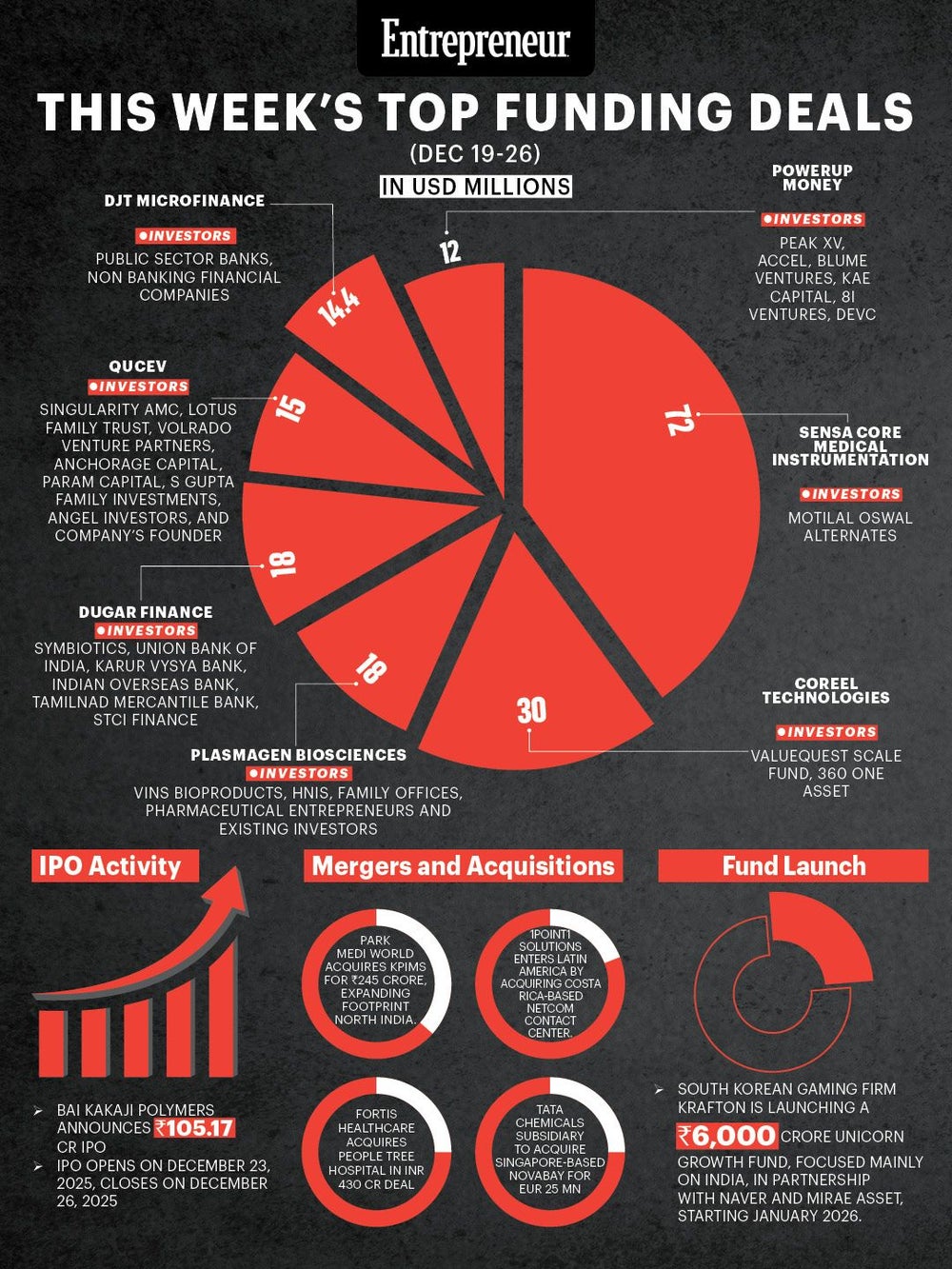

This Week's Top Funding Deals, IPOs, M&A, and Fund Launches (Dec 19–26) Sensa Core Medical Instrumentation, CoreEL Technologies, PlasmaGen Biosciences, Dugar Finance, Qucev, DJT Microfinance and PowerUp Money led this week's top funding deals across healthtech, defence, fintech, EV and wealthtech sectors.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

India's startup and corporate ecosystem remained active during the week of December 19–26, with significant capital inflows across healthtech, defence electronics, fintech, EV manufacturing, and wealth management. Large late-stage rounds, strategic acquisitions in healthcare and BPM, an SME IPO, and the announcement of a mega technology-focused fund highlighted strong investor confidence despite global uncertainties.

Top Funding Deals

Sensa Core Medical Instrumentation (Healthtech, Medical Devices)

Sensa Core Medical Instrumentation is a Hyderabad-based diagnostics company focused on developing and manufacturing in-vitro diagnostic (IVD) and point-of-care (POC) devices. Its portfolio includes electrolyte and blood gas analyzers, glucose meters, hemoglobin meters, and ion-selective electrode-based solutions used by hospitals and diagnostic labs worldwide.

- Inception: 2006

- Headquartered: Hyderabad

- Founder: Dr Ravi Kumar Meruva

- Funding Amount: USD 72 million

- Investor: Motilal Oswal Alternates

CoreEL Technologies (Defencetech, Electronics Systems)

CoreEL Technologies designs and manufactures advanced electronic systems and subsystems for strategic and commercial applications. The company works across radar systems, electronic warfare, avionics, and military communications, delivering high-end solutions to defence and aerospace customers in India and abroad.

- Inception: 1999

- Headquartered: Bengaluru

- Founders: Ravi Sharma, Vishwanath Padur

- Funding Amount: USD 30 million

- Investors: ValueQuest Scale Fund, 360 ONE Asset

PlasmaGen Biosciences (Biotech, Plasma Therapies)

PlasmaGen Biosciences focuses on plasma-derived therapies such as immunoglobulin, albumin, and clotting factors. These therapies are used to treat immune deficiencies, liver disorders, bleeding conditions, and infections. The company operates a plasma fractionation facility in Kolar, Karnataka, which became commercially operational in 2024.

- Inception: 2010

- Headquartered: Bengaluru

- Founder: Vinod Nahar

- Funding Amount: USD 18 million

- Investors: ViNS Bioproducts, HNIs, family offices, pharma entrepreneurs, existing investors

Dugar Finance (Fintech, NBFC)

Dugar Finance is an RBI-registered NBFC focused on financial inclusion in semi-urban and rural India. It provides commercial vehicle loans, loans against property for SMEs, mortgage loans, and green financing solutions for micro-entrepreneurs and first-time borrowers.

- Inception: 1987

- Headquartered: Chennai

- Founders: Ramesh Dugar, Sonali Dugar

- Funding Amount: USD 18 million

- Investors: Symbiotics, Union Bank of India, Karur Vysya Bank, Indian Overseas Bank, Tamilnad Mercantile Bank, STCI Finance

Qucev (EV Manufacturing, Clean Mobility)

Qucev (EV Manufacturing, Clean Mobility)

Qucev partners with China-based EV major BYD to design and manufacture electric tractors, trucks, buses, and three-wheelers. Beyond manufacturing, the company offers financing solutions, charging infrastructure, and integrated fleet services to accelerate EV adoption in commercial mobility.

- Inception: 2022

- Headquartered: Hyderabad

- Founder: Naresh Rawal

- Funding Amount: USD 15 million

- Investors: Singularity AMC, Lotus Family Trust, Volrado Venture Partners, Anchorage Capital, Param Capital, S Gupta Family Investments, angels, founder

DJT Microfinance (Fintech, Microfinance)

DJT Microfinance is an RBI-registered NBFC-MFI providing collateral-free loans to low-income households, primarily women entrepreneurs in rural Uttar Pradesh, Uttarakhand, Bihar, and West Bengal. The loans support micro-enterprises such as tailoring, small trade, and livestock rearing.

- Inception: 2021

- Headquartered: Noida

- Founders: Akash Anand, Manish Prasad

- Funding Amount: USD 14.4 million

- Investors: Public sector banks, NBFCs

PowerUp Money (Wealthtech, Mutual Fund Advisory)

PowerUp Money offers unbiased, research-driven mutual fund advisory through a subscription-based model. A SEBI-registered platform, it provides free portfolio health checks and paid plans such as PowerUp Elite for personalised advice, fund selection, and portfolio rebalancing, aiming to democratise institutional-grade wealth management.

- Inception: 2024

- Headquartered: Bengaluru

- Founder: Prateek Jindal

- Funding Amount: USD 12 million

- Investors: Peak XV, Accel, Blume Ventures, Kae Capital, 8i Ventures, DevC

Mergers and Acquisitions

Park Medi World Limited agreed to acquire KP Institute of Medical Sciences (KPIMS) in an all-cash deal valued at INR 245 crore, expanding its hospital footprint in North India. Fortis Healthcare also acquired Bengaluru-based People Tree Hospital for INR 430 crore.

In the BPM space, AI-driven 1Point1 Solutions entered Latin America by acquiring Costa Rica-headquartered Netcom Business Contact Center for USD 33.37 million. Separately, a Tata Chemicals subsidiary announced the acquisition of Singapore-based Novabay for EUR 25 million.

IPO

Bai Kakaji Polymers announced an INR 105.17 crore IPO, with the issue opening on December 23, 2025, and closing on December 26, 2025, marking one of the notable SME public offerings of the week.

Fund Launch

South Korean gaming major Krafton announced the launch of a new technology-focused investment vehicle, the Unicorn Growth Fund, targeting a corpus of up to INR 6,000 crore. Created in partnership with Naver and Mirae Asset, the fund will prioritise India and is expected to begin operations in January 2026.