From Space Tech to EVs, Bengaluru Dominates Startup Funding Activity This Week Dec 12–18, 2025 Startups Highlights

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

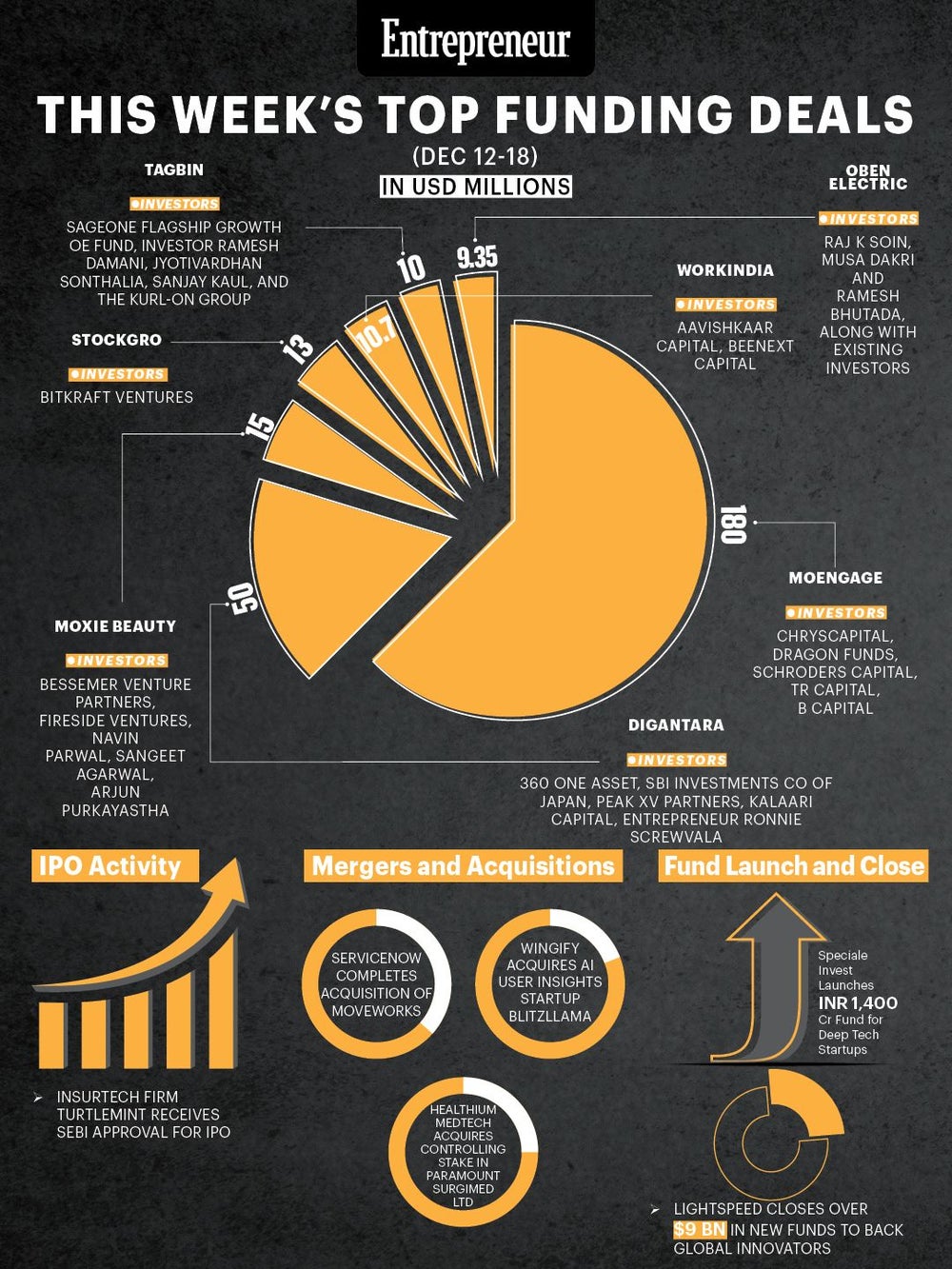

The Indian startup ecosystem witnessed an impressive surge in funding activity this week, with overall investments rising approximately 46 percent compared to the previous week of December 6-11, 2025, according to Tracxn.

Investor confidence appears strong as venture capital flows into sectors ranging from fintech and space tech to beauty and EVs. In addition to notable funding rounds, this week also saw key IPO approvals, mergers and acquisitions, and significant fund launches, highlighting a dynamic week for innovation and capital inflow.

Week's Top Funding Deals (Dec 12-18, 2025)

MoEngage (Customer Engagement)

MoEngage provides insight-driven customer engagement tools that help brands connect with users across web, mobile, email, and messaging channels. Its offerings include MoEngage Inform for transactional messaging like OTPs, account updates, and product analytics that combine behavioral data with real-time engagement insights.

- Inception: 2014

- Based-out: California and Bengaluru

- Founders: Raviteja Dodda and Yashwanth Kumar

- Funding Amount: USD 180 Million

- Investors: ChrysCapital, Dragon Funds, Schroders Capital, TR Capital, B Capital

Digantara (SpaceTech)

Digantara develops both space-based and ground-based infrastructure to support safe and secure space operations. Its AIRA platform integrates sensing hardware, data processing, and analytics, while its SCOT constellation, ALBATROSS series, and SKYGATE ground network provide orbital insights and missile tracking.

- Inception: 2020

- Based-out: Bengaluru

- Founders: Anirudh Sharma

- Funding Amount: USD 50 Million

- Investors: 360 ONE Asset, SBI Investments Co of Japan, Peak XV Partners, Kalaari Capital, Ronnie Screwvala

Moxie Beauty (Haircare)

Moxie Beauty specialises in haircare solutions for Indian hair textures and climate conditions. Its portfolio includes 19 products covering hair care, styling, maintenance, and scalp health, including shampoos, conditioners, hair finishing sticks, and wax sticks for quick styling.

- Inception: 2023

- Based-out: New Delhi

- Founders: Nikita Khanna and Anmol Ahlawat

- Funding Amount: USD 15 Million

- Investors: Bessemer Venture Partners, Fireside Ventures, Navin Parwal, Sangeet Agarwal, Arjun Purkayastha

StockGro (Fintech)

StockGro is a fintech platform connecting users with SEBI-registered advisors for stock market guidance. It provides investment advisory services, portfolio support, and educational resources, while its AI assistant Stoxo combines expert inputs and community insights to help investors make informed decisions.

- Inception: 2020

- Based-out: Bengaluru

- Founders: Ajay Lakhotia

- Funding Amount: USD 13 Million

- Investors: BITKRAFT Ventures

WorkIndia (HRTech)

WorkIndia (HRTech)

WorkIndia connects blue- and grey-collar workers with employers, offering temporary staffing, recruitment, and work-from-home opportunities. It leverages machine learning recommendations and fast candidate calling to simplify hiring for MSMEs across logistics, e-commerce, banking, and education sectors.

- Inception: 2015

- Based-out: Bengaluru

- Founders: Kunal Patil, Nilesh Dungarwal, Moiz Arsiwala

- Funding Amount: USD 10.7 Million

- Investors: Aavishkaar Capital, BEENEXT Capital

Tagbin (Experiential Tech)

Tagbin offers immersive tech experiences combining AR, VR, robotics, and AI for governance, museums, brand centers, and infotainment. Its projects include Pradhanmantri Sangrahalaya, Netaji holograms, and AI-driven governance platforms, with private collaborations like Coca-Cola's brand centers.

- Inception: 2013

- Based-out: Gurugram

- Founders: Saurav Bhaik and Ankit Sinha

- Funding Amount: USD 10 Million

- Investors: SageOne Flagship Growth OE Fund, Ramesh Damani, Jyotivardhan Sonthalia, Sanjay Kaul, Kurl-on Group

Oben Electric (Electric Motorcycles)

Oben Electric focuses on electric motorcycles and critical EV components. Operating a 3.5-acre facility in Bengaluru, the company produces batteries, motors, chargers, and displays. Its Rorr EZ Sigma motorcycle features reverse mode, ergonomic design, and a connected TFT display for city commuting.

- Inception: 2020

- Based-out: Bengaluru

- Founders: Dinkar Agrawal and Madhumita Agrawal

- Funding Amount: USD 9.35 Million

- Investors: Raj K Soin, Musa Dakri, Ramesh Bhutada, and existing investors

IPOs

Mumbai-based insurtech firm Turtlemint has received SEBI approval to launch its IPO. Founded in 2015 by Dhirendra Mahyavanshi and Anand Prabhudesai, Turtlemint connects financial advisors with insurance customers. The company plans to raise up to INR 2,000 crore through the offering, following a confidential Draft Red Herring Prospectus filed in May 2025.

Mergers and Acquisitions

- ServiceNow completes acquisition of Moveworks.

- Wingify acquires AI user insights startup Blitzllama.

- Healthium Medtech acquires controlling stake in Paramount Surgimed Ltd.

Fund Launches and Closures

- Speciale Invest launches an INR 1,400 crore fund for deep tech startups.

- Lightspeed closes over USD 9 billion in new funds to back global innovators.