Time to Buy eBay Stock on a Lowered Bar Opportunity

Online marketplace platform eBay (NASDAQ: EBAY) stock was pummeled on its Q1 2021 earnings release as shares fell (-11%) following multiple analyst downgrades. The stock market tends to follow narrative templates for price action.

This story originally appeared on MarketBeat

Online marketplace platform eBay (NASDAQ: EBAY) stock was pummeled on its Q1 2021 earnings release as shares fell (-11%) following multiple analyst downgrades. The stock market tends to follow narrative templates for price action. When Pinterest (NYSE: PINS) reported strong earnings but suggested a compression moving forward due to the benefits from the pandemic wearing off as COVID vaccinations accelerate, they injected a negative narrative that spread across e-commerce and social media stocks. This narrative assumes the best performance is in “the rearview mirror” as consumers return to their normal routines with the re-opening. However, a “new normal” has been spawned as a result of the pandemic. This includes elastic offices, connected fitness, greater reliance on mobility amidst the rollout and adoption of 5G. Additionally, trends in collectibles remain stronger than ever powered by the perfectly timed pace of the Disney (NYSE: DIS) Marvel Cinematic Universe (MCU) Phase 4 rollout of live-action Disney+ shows and movies and the WarnerMedia (NYSE: T) HBO Max slate of DC Universe live action programs and motion pictures. Unlike Pinterest, eBay is profitable and selling at an even greater discounted P/E of 14.5 versus Etsy (NASDAQ: ETSY) with a P/E of 47 and Pinterest with no profits. The sell-off is providing opportunistic pullback levels to scale into shares at cheaper valuations as the underlying metrics tell a different story.

Q1 FY 2021 Earnings Release

On April 28, 2021, eBay released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported earnings-per-share (EPS) profit of $1.09 excluding non-recurring items versus consensus analyst estimates for a profit of $1.07, beating estimates by $0.02. Revenues rose 38% on an FX-neutral basis year-over-year (YoY) to $3 billion versus $2.97 billion analyst estimates. Gross merchandise value (GMV) grew 29% YoY to $27.5 billion. Annual active buyers grew 7% YoY to 187 million. Annual active sellers grew 8% to 20 million. eBay Managed Pay reached 52% of global on-platform volume resulting in reduction in unpaid items by 80% on fixed price transactions. Promoted Listing revenues rose 64% YoY to $224 million. The Company saw notable YoY growth in collectibles ranging from sneaker (up 2X), luxury watches (up 14% sequentially), and Trading Cards (GMV surpassed $1 billion and 2X active buyers) implementing its new computer vision scanning tool to reduce listing times by 75%.

Mixed Q2 2021 Guidance

The Company provided mixed guidance for Q2 2021 for EPS coming in between $0.91 to $0.96 versus $1.02 consensus analyst estimates with revenues coming in between $2.98 to $3.03 billion versus $2.91 consensus analyst estimates.

Conference Call Takeaways

eBay CEO, Jamie lannone, detailed the migration of its sellers to eBay Managed Payments, “We remain on track to complete the vast majority of the payments transition by the end of this year, which will deliver our stated financial goals of at leastan incremental $2 billion in revenue and $500 million in annualized operating income in 2022.” He also noted the 58% Q1 2021 revenue growth in Promoted Listings to $224 million, “More than 1.3 million sellers promoted close to 400 million listings during the quarter. Growth was driven by increased seller adoption and AI improvements that increased conversions.” The collectibles market is molten hot, and eBay is capitalizing on cross-promotion within the demographic, “Our luxury watch buyers like our sneakers enthusiasts spend thousands of dollars on other categories across the platform. In addition, based on the value we are delivering in luxury watches, we recently raised fees in this category to create more investment capacity.” eBay is the leader in trading cards reaching GMV of over $1 billion in the quarter, “Active buyers of trading cards doubled, and existing buyers purchased more items at higher prices than last year. To dramatically simplify selling, we’ve recently launched image-based scanning for our top selling trading cards.”

Thanks For Nothing, Pinterest!

What was a strong quarter was overshadowed by the template shaped by Pinterest’s earnings release on April 27, 2021. Granted Pinterest grew it’s Q1 2021 top-line by 78% YoY, the Company did mention that the re-openings may slow down its pace of user growth as people return to the normal. This triggered a (-14%) sell-off in shares and spread contagion to other social media and e-commerce stocks. This was the back drop going into eBay’s earnings release the following day.

eBay’s Move into NFTs

CEO lannone commented in a CNBC interview that the Company was exploring opening up a non-fungible token (NFT) marketplace. This would be a logical move for the Company. However, it would also need to enable digital wallets for cryptocurrencies since that’s what’s used to pay for NFTs. In essence, eBay would have to migrate into the blockchain, and cryptocurrencies and the tax accounting could be a nightmare for both buyers and sellers. The bar has been lowered heading into Q2 2021. Prudent investors seeking exposure at a discount, can watch for opportunistic pullback levels.

EBAY Opportunistic Pullback Levels

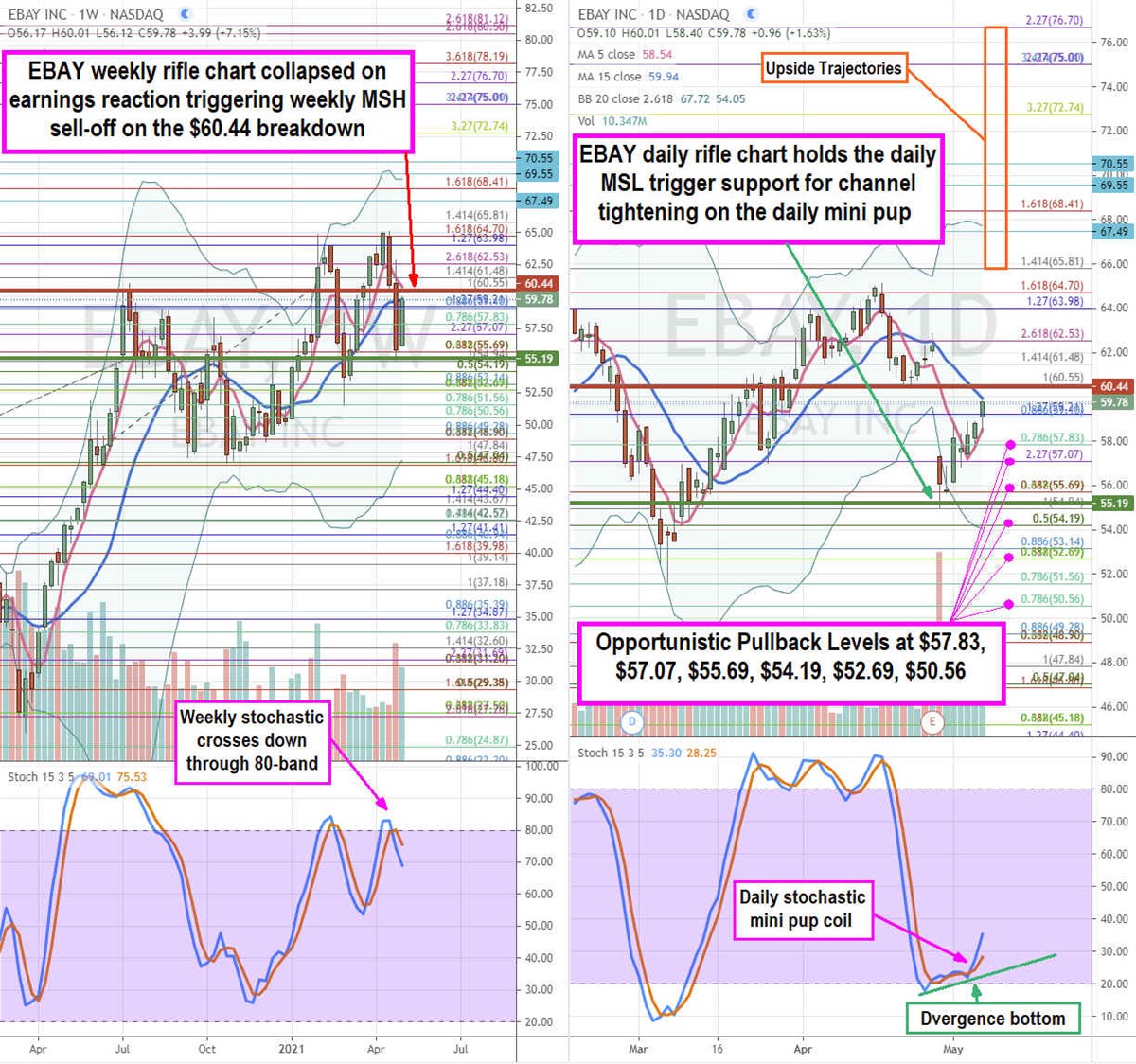

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the price action landscape for EBAY stock. The weekly rifle chart had a mini pup heading into the earnings report as it formed a double-top at the $64.70 Fibonacci (fib) level. Unfortunately, the earnings reaction pummeled the pattern as the weekly market structure high (MSH) sell triggered on the collapse through $60.44. The weekly 5-period moving average (MA) is sloping down at $60.78 as the weekly 15-period MA flattens at $59.82. The weekly stochastic crossed down through the 80-band setting up a potential oscillation down. The daily rifle chart formed a bearish inverse pup breakdown that bottomed out at the prior market structure low (MSL) trigger at $55.19. The daily stochastic bounced back up through the 20-band with higher highs forming a divergence bottom. The daily 5-period MA is rising at $58.54 as it tightens towards the daily 15-period MA at $59.94. Shares should pullback after testing the weekly 5-period MA. Prudent investors can watch for opportunistic pullback levels at the $57.83 fib, $57.07 fib, $55.69 fib, $54.19 fib, $52.69 fib, and the $50.56 fib. Upside trajectories range from the $65.81 fib up towards the $76.70 level.

Featured Article: Marijuana Stocks Future Looks Bright

Online marketplace platform eBay (NASDAQ: EBAY) stock was pummeled on its Q1 2021 earnings release as shares fell (-11%) following multiple analyst downgrades. The stock market tends to follow narrative templates for price action. When Pinterest (NYSE: PINS) reported strong earnings but suggested a compression moving forward due to the benefits from the pandemic wearing off as COVID vaccinations accelerate, they injected a negative narrative that spread across e-commerce and social media stocks. This narrative assumes the best performance is in “the rearview mirror” as consumers return to their normal routines with the re-opening. However, a “new normal” has been spawned as a result of the pandemic. This includes elastic offices, connected fitness, greater reliance on mobility amidst the rollout and adoption of 5G. Additionally, trends in collectibles remain stronger than ever powered by the perfectly timed pace of the Disney (NYSE: DIS) Marvel Cinematic Universe (MCU) Phase 4 rollout of live-action Disney+ shows and movies and the WarnerMedia (NYSE: T) HBO Max slate of DC Universe live action programs and motion pictures. Unlike Pinterest, eBay is profitable and selling at an even greater discounted P/E of 14.5 versus Etsy (NASDAQ: ETSY) with a P/E of 47 and Pinterest with no profits. The sell-off is providing opportunistic pullback levels to scale into shares at cheaper valuations as the underlying metrics tell a different story.

Q1 FY 2021 Earnings Release

On April 28, 2021, eBay released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported earnings-per-share (EPS) profit of $1.09 excluding non-recurring items versus consensus analyst estimates for a profit of $1.07, beating estimates by $0.02. Revenues rose 38% on an FX-neutral basis year-over-year (YoY) to $3 billion versus $2.97 billion analyst estimates. Gross merchandise value (GMV) grew 29% YoY to $27.5 billion. Annual active buyers grew 7% YoY to 187 million. Annual active sellers grew 8% to 20 million. eBay Managed Pay reached 52% of global on-platform volume resulting in reduction in unpaid items by 80% on fixed price transactions. Promoted Listing revenues rose 64% YoY to $224 million. The Company saw notable YoY growth in collectibles ranging from sneaker (up 2X), luxury watches (up 14% sequentially), and Trading Cards (GMV surpassed $1 billion and 2X active buyers) implementing its new computer vision scanning tool to reduce listing times by 75%.