Fasten Your Seatbelts, Fastenal Is About To Move Higher Fastenal (NASDAQ: FAST) has been on our watchlist for quite some time due to its positioning in the industrial, housing, and retail markets. The company manufacturers and markets a wide...

By Thomas Hughes •

This story originally appeared on MarketBeat

Fast-Acting Fastenal Execs Grow Business And Widen Margin

Fastenal (NASDAQ: FAST) has been on our watchlist for quite some time due to its positioning in the industrial, housing, and retail markets. The company manufacturers and markets a wide range of tools, safety products, and fasteners (nails, screws, staples, etc) and is reporting strong demand in all channels. The best news is that both revenue and earnings are growing and that earnings growth is outpacing revenue growth as pricing increases fully offset the impacts of inflation. The Q1 report wasn't a blowout but, considering the times we are in, the business results represent the best of what the market can expect from the Q1 reporting season. And it pays a safely growing dividend, so there's that, too.

Fastenal Beats On The Top And Bottom Line

Fastenal reported a great quarter in which revenue grew 20.3% to $1.7 billion. The gain is driven by higher pricing but that only accounted for 580 to 610 basis points. The rest is driven by organic gains across channels and at a level slightly above the Marketbeat.com consensus. There is also an extra day to consider but that only impacted results by 190 basis points. On a daily sales basis, sales are up 18.4% led by a 24.6% increase in Fastener sales. Fasteners represent about 32% of the net while the Other category, which includes all the tools, represents 44.7% of the net and grew by 14.8%. The third category, Safety, grew by 15.3% on top of the COVID-driven increases of the last two years. The real takeaway is that these results are the 3rd consecutive quarter of YOY acceleration and a company record.

As good as the top-end results are, the lower-end numbers are better. Pricing increases and internal efficiency widened the margin at both the gross and operating levels. Gross margin increased by 90 bps to 46.6% to drive a 23.3% increase in gross profit. On the bottom line, the operating margin increased 230 basis points to drive a 27.7% increase in the operating income. Operating income gains were aided by a decrease in SG&A that helped produce $0.47 in GAAP earnings or up 27% from last year and $0.02 ahead of the Marketbeat.com consensus. And that all include a 22.6% YOY increase in inventory and a 230 basis point reduction in net debt. Fastenal did not give any guidance but the outlook is favorable if clouded by economic headwinds.

Fastenal Grows Its Dividend, And Not Slowly

Fastenal is a high-quality dividend payer with a fortress balance sheet that yields 2.15%. The company has also been increasing it on a regular annual basis and is on the verge of Dividend Aristocrat status. The CAGR is a nice 13% that we see as sustainable in light of revenue and earnings growth. Longer-term, investors should expect the growth rate to slow, however, because the company is paying almost 70% of earnings as dividends.

The institutions like the payment, if their activity is any indication. The institutions have been net buyers of the stock for the last 7 quarters and hold 77% of the shares. Their activity slowed in Q1 but we see it picking up again now that earnings are out.

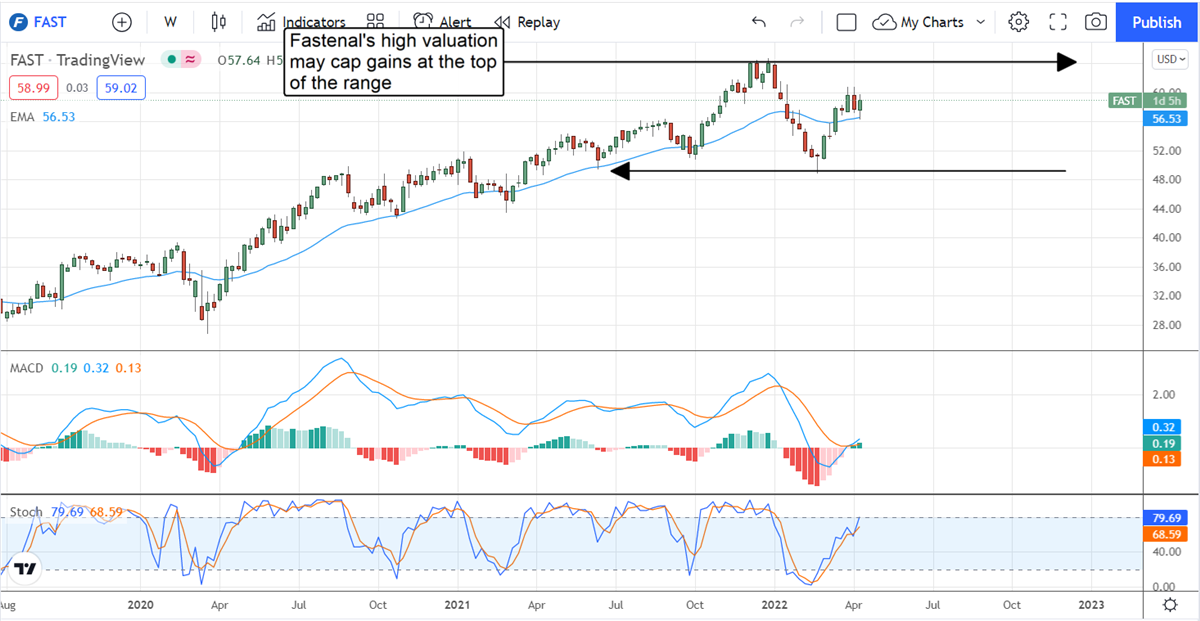

The Technical Outlook: Fastenal Confirms Uptrend

The market for Fastenal confirmed an uptrend in the wake of the Q1 results but there is a caveat. The stock is trending higher but within a range that could cap gains. The top of the range is at the $64 where prices were capped in late 2021. If the market can get above that level, we see it moving up into the $72 to $75 range, if not the current range will most likely hold until the next earnings season rolls around.