Exxon Mobil Stock Is Likely Running on Empty at These Levels

InvestorPlace – Stock Market News, Stock Advice & Trading TipsOut of the pandemic XOM stock was a bargain yielding 9.6% in dividend income. Now the reward is half and…

This story originally appeared on InvestorPlace

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Oil markets are difficult to trade under normal circumstances. By the definition this is a rigged game — pun on purpose. There is a global coalition, OPEC, that colludes to set production levels and prices. Such an activity is illegal in the United States, so investors in oil must accept that cheating is OK. Today I will discuss how this affects trading Exxon Mobil (NYSE:XOM) stock.

You couldn’t tell that it is suffering from manipulation because XOM stock is on a roll. It has enjoyed a strong rally off the pandemic bottom.

Spoiler alert, I am not a fan of taking bullish positions from these levels. My message is that this is not an obvious entry point. I suggested that opportunity when they were out of favor and miles below current prices.

Back then my thesis was to collect a 9% dividend rate. Up here, the yield is about half in percentage terms. Since it has rallied so much, it created a potential vacuum below. If prices correct, that would more than offset the benefits of collecting the dividends.

The Oil Crisis May Be Fiction

Even before the crisis in the Ukraine, experts were already pumping — another pun — a shortage. I challenge that thesis because it’s an artificial imbalance of supply and demand.

The future demand on fossil fuels is by design on track to fall sharply. The world has accepted that electric vehicles will replace internal-combustion engines. If true, then there will be a cliff-dive effect on about half of the demand for oil. Add to this the explosion in popularity of ESG investing, and the bullish oil thesis becomes an oxymoron.

There is a special threat from the Ukraine crisis, but it’s temporary. If the problems persist, the U.S. has a huge capacity on demand, not to mention a giant horde. Therefore, if push comes to shove, they can turn on the spigots to avert a crisis. The bottom line, if indeed there is a giant problem, the federal government will be able to snuff it.

The price action in XOM from Tuesday makes my argument for me. Oil spiked on the deterioration of the situation in the Ukraine. XOM and Chevron (NYSE:CVX) stocks soared in sympathy. But then they both reversed lower, and XOM closed near its lows down -1.2%.

CVX stock is even in a more ridiculous situation, because it already made new all-time highs. I find it unlikely they can sustain that or build much higher highs on top.

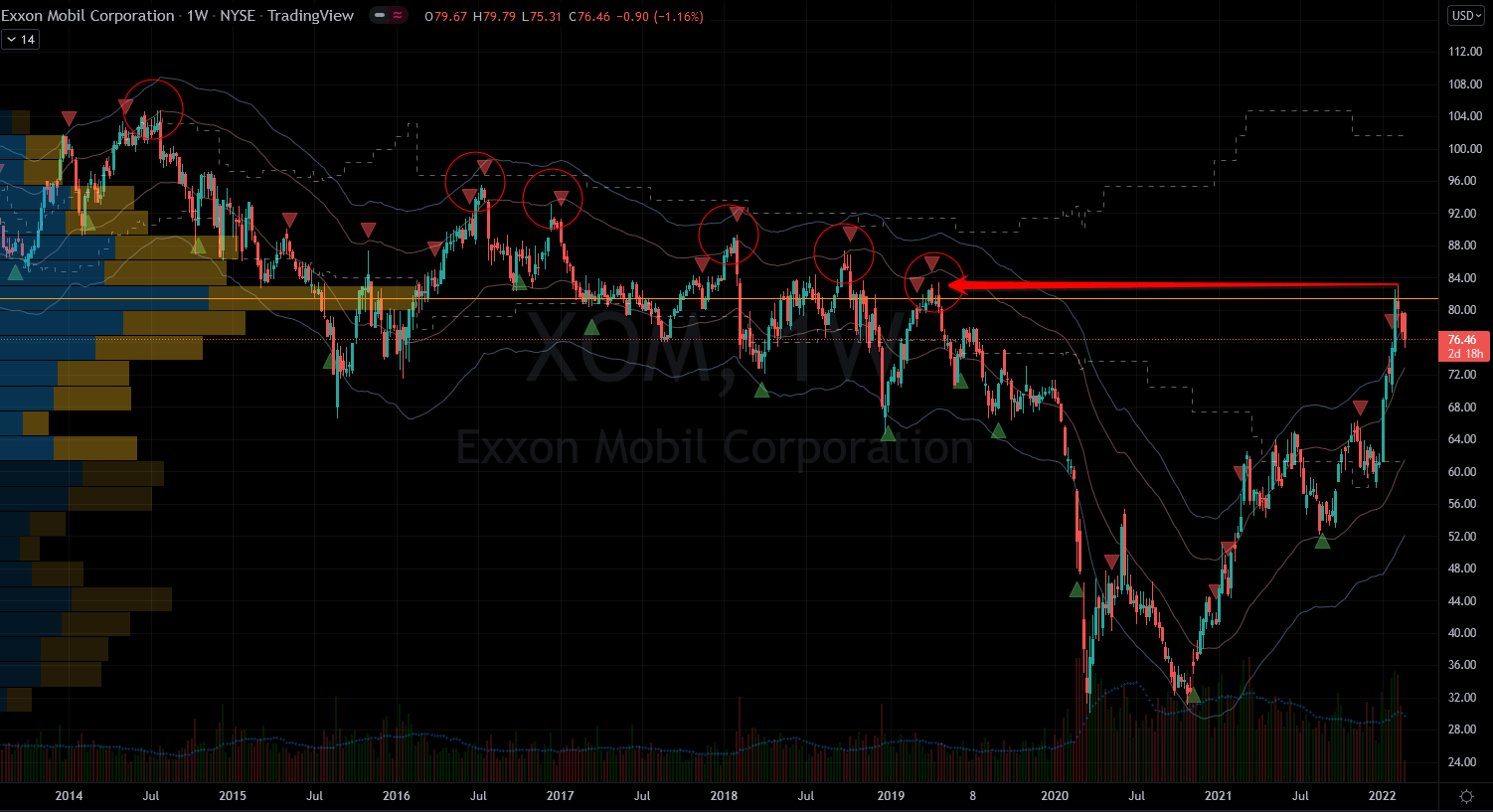

I understand momentum traders chase breakouts with tactical trades. But I totally disagree with a new position for an investment purpose. Fast hands can buy high and sell higher, but that is not most readers. Going into XOM stock now for the yield is a bit too late. Speaking of technicals, the zone between $80 and $84 per share is now a big hurdle for the bulls. It failed there Tuesday and on Feb. 11.

XOM Stock Resistance Started in 2014

That wasn’t a random level because the contention there is from April 2019. Back then it marked a giant top from which XOM fell 60% twice because of the pandemic. More important was what happened coming into that giant cliff. XOM had made at least seven massive weekly failed breakouts over seven years.

Clearly there are sellers lurking and it will take extreme strength to bust through now. When stocks rally back into such prior points of contention, they struggle. Those who had been long from 2019 and in pain may take the opportunity to exit close to even.

I don’t want to short the stock outright. But my point today is that this is not an obvious entry point. Investors who take offense from such a statement may have too much emotion into it. Besides, if indeed the Russian crisis develops into more serious threat, all stocks will fall, including oil stocks. At this point, I can find hundreds of better opportunities fundamentally and technically.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Nicolas Chahine is the managing director of SellSpreads.com.

More From InvestorPlace

- Stock Prodigy Who Found NIO at $2… Says Buy THIS Now

- Man Who Called Black Monday: “Prepare Now.”

- Get in Now on Tiny $3 “Forever Battery’ Stock

- Interested in Crypto? Read This First…

The post Exxon Mobil Stock Is Likely Running on Empty at These Levels appeared first on InvestorPlace.

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Oil markets are difficult to trade under normal circumstances. By the definition this is a rigged game — pun on purpose. There is a global coalition, OPEC, that colludes to set production levels and prices. Such an activity is illegal in the United States, so investors in oil must accept that cheating is OK. Today I will discuss how this affects trading Exxon Mobil (NYSE:XOM) stock.