Launch Your Quest for Capital With Entrepreneur Bank Search

Opinions expressed by Entrepreneur contributors are their own.

Building a business can be an exciting journey. But securing the money you need can be an overwhelming process.

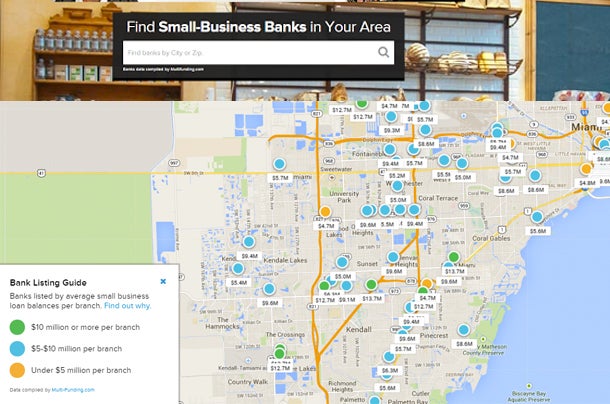

That’s why we teamed with MultiFunding, a Pennsylvania-based loan-advisory firm, to launch Entrepreneur Bank Search — a straightforward and time-saving tool to help you discover which banks are lending to U.S. small enterprise.

Type in your zip code or city in the search bar to find and evaluate banks in your community. The search engine generates local listings and performance data on a map to help you start your search. The hyper-local engine is designed to save you precious time as a busy small-business owner.

Visit: Entrepreneur Bank Search — A search tool to help you discover local banks.

MultiFunding uses quarterly FDIC data to identify which banks have shown a track record of small-business lending.

Finding the right lender is just one component of small-business financing. It’s important to conduct independent research and speak with a financial planner before applying for a loan with any financial institution. Here are quick guides to help you get started:

- To learn about traditional bank loans and different types of financing, check out The Small-Business Guide to Getting the Cash You Need.

- Understand the forces impacting the small-business lending environment in The 3 Big Obstacles for Small-Business Owners from Sageworks.

- In Why Big Banks Are Lending More to Small Businesses, the Biz2Credit CEO explains why larger banks are warming up to small-business lending again.

- Macroeconomic conditions aside, getting a loan relies on other components: credit score (business and personal), collateral and cash flow. MultiFunding’s CEO explains What Lenders Are Looking For in Small Business Owners.

Related: How to Finance a Startup Today

Building a business can be an exciting journey. But securing the money you need can be an overwhelming process.

That’s why we teamed with MultiFunding, a Pennsylvania-based loan-advisory firm, to launch Entrepreneur Bank Search — a straightforward and time-saving tool to help you discover which banks are lending to U.S. small enterprise.

Type in your zip code or city in the search bar to find and evaluate banks in your community. The search engine generates local listings and performance data on a map to help you start your search. The hyper-local engine is designed to save you precious time as a busy small-business owner.