Is Comstock Resources a Good Oil & Gas Stock to Own in 2022?

Shares of oil and gas exploration company Comstock Resources (CRK) have rallied nearly 160% in price over the past year on the back of surging energy prices. However, given that…

This story originally appeared on StockNews

Shares of oil and gas exploration company Comstock Resources (CRK) have rallied nearly 160% in price over the past year on the back of surging energy prices. However, given that JP Morgan recently cut its global oil demand forecast for 2022, would it be worth adding the stock to one’s portfolio now? Read on. Let’s find out.

Comstock Resources, Inc. (CRK) in Frisco, Tex., is an independent energy company that specializes in acquiring, exploring, developing, and producing oil and natural gas. As of Dec. 31, 2021, the business had 6.1 trillion cubic feet of natural gas equivalent proven reserves. It also has a stake in 2,557 producing oil and natural gas wells.

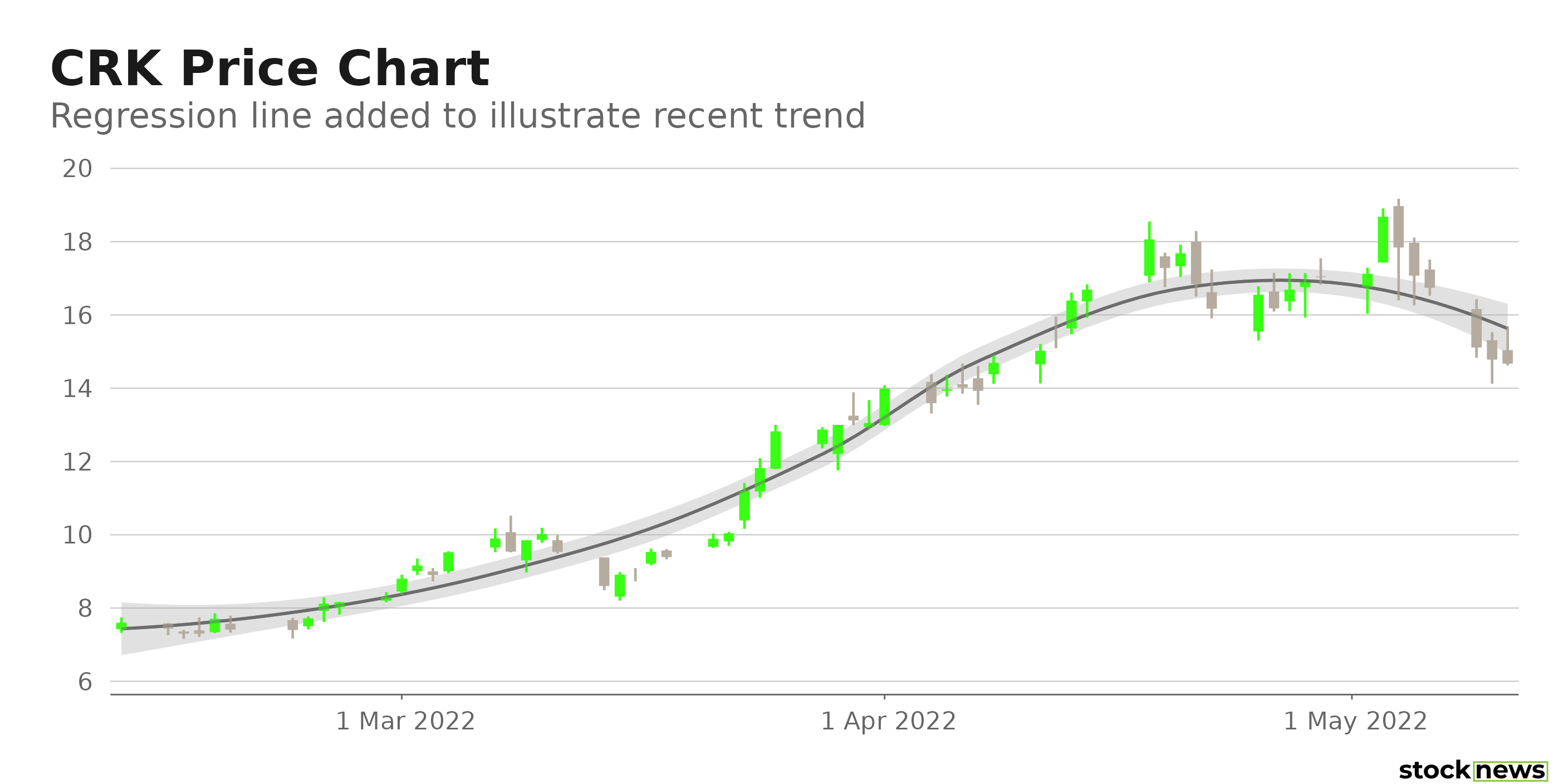

Its shares have gained 160.6% in price over the past year and 81.3% year-to-date to close yesterday’s trading session at $14.67. Soaring oil and gas prices have contributed to the stock’s price rally.

Also, CRK announced the early redemption of its outstanding 7.50% senior notes due 2025. The outstanding aggregate principal amount of the notes is $244.4 million. They will be redeemed in full on May 15, 2022, funded by cash on hand and borrowings under the company’s revolving credit facility.

Here’s what could shape CRK’s performance in the near term:

Bleak Outlook

Last week, JP Morgan cut its global oil demand forecast for 2022 by one million barrels per day (BPD), citing increased oil prices, a worsening GDP outlook, and growing geopolitical tensions. “We now see total oil demand averaging 100 million BPD, 400,000 BPD below 2019 levels,” the bank stated in a weekly note.

Mixed Profitability

CRK’s 85.7% trailing-12-months gross profit margin is 111.7% higher than the 40.5% industry average. Its $949.7 million trailing-12-months cash from operations is 162.3% higher than the $362.09 million industry average. However, its trailing-12-months ROA, net income margin, and ROE are negative 4.6%, 10.8%, and 23.3%, respectively. Also, its0.43%trailing-12-months asset turnover ratiois 18.3% lower than the 0.53% industry average.

Discounted Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 5.97x, which is 33.05% lower than the 8.92x industry average. Also, its 3.01x forward Price/Cash Flowis 36.8% lower than the 4.76x industry average. Furthermore, CRK’s 9.28x forward EV/EBIT is 6.6% lower than the 9.94x industry average.

POWR Ratings Reflect Uncertainty

CRK has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight different categories. CRK has a D grade for Stability and a C for Quality. The stock’s 1.30 beta is in sync with the Stability grade. And the company’s mixed profitability is consistent with the Quality grade.

Among the 98 stocks in the B-rated Energy – Oil & Gas industry, CRK is ranked #64.

Beyond what I’ve stated above, one can view CRK ratings for Growth, Momentum, Value, and Sentiment here.

Bottom Line

CRK has exhibited robust momentum over the past year and has met analysts’ expectations in its recent earnings release. However, analysts expect its revenue to decline by 1.4% in the current year. In addition, an anticipated slowing in oil and gas demand in the coming months could impact the company’s growth prospects. So, we believe investors should wait before scooping its shares.

How Does Comstock Resources Inc. (CRK) Stack Up Against its Peers?

While CRK has an overall C rating, one might want to consider its industry peers, Unit Corp. (UNTC), Adams Resources & Energy Inc. (AE), and Whitecap Resources Inc. (SPGYF), which have an overall A (Strong Buy) rating.

CRK shares fell $14.67 (-100.00%) in premarket trading Thursday. Year-to-date, CRK has gained 81.33%, versus a -17.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing.In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Comstock Resources a Good Oil & Gas Stock to Own in 2022? appeared first on StockNews.com

Shares of oil and gas exploration company Comstock Resources (CRK) have rallied nearly 160% in price over the past year on the back of surging energy prices. However, given that JP Morgan recently cut its global oil demand forecast for 2022, would it be worth adding the stock to one’s portfolio now? Read on. Let’s find out.

Comstock Resources, Inc. (CRK) in Frisco, Tex., is an independent energy company that specializes in acquiring, exploring, developing, and producing oil and natural gas. As of Dec. 31, 2021, the business had 6.1 trillion cubic feet of natural gas equivalent proven reserves. It also has a stake in 2,557 producing oil and natural gas wells.

Its shares have gained 160.6% in price over the past year and 81.3% year-to-date to close yesterday’s trading session at $14.67. Soaring oil and gas prices have contributed to the stock’s price rally.