April 28th is Pivotal Day for Stock Market

Bulls and bears have been squabbling over the direction of the stock market (SPY) since the start of the year. Right now the bears are winning. But the bulls have…

This story originally appeared on StockNews

Bulls and bears have been squabbling over the direction of the stock market (SPY) since the start of the year. Right now the bears are winning. But the bulls have not lost hope because the economy seems to be in fine shape. That may all change Thursday morning, April 28th when the GDP report comes out. This key announcement could truly be a catalyst in either direction. This commentary will get you ready for whatever comes our way on 4/28. Read on for more.

(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Stocks are retesting the lows established in late February before a glorious, but short lived, March bounce. On the surface we are dealing with the same elements as before:

- High Inflation

- Hawkish Fed

- Russia/Ukraine

Yet these negatives all were happening with no real harm being done to the economy as it appeared report by report. But the well respected Atlanta Fed GDPNow model just dipped to only +0.4% growth rate for Q1. That is way to close to a recessionary territory and why more investors got to selling stocks this week.

This makes the Thursday morning release of Q1 GDP a pivotal event for investors. Let’s focus on that topic in this week’s commentary.

Market Commentary

Let’s set the scene.

The 3 negatives of high inflation, hawkish Fed and Russia/Ukraine provide ample reason for investors to pause after 2 years of non-stop stock advances. This should have them searching high and low for any serious signs of weakness in the economy or corporate earnings to determine if indeed the next recession and bear market are on the way.

We have vigilantly done that in the Reitmeister Total Return commentary analyzing each key economic report as it came out with nary a chink in the armor. Same goes for monitoring the start of Q1 earnings season for any clues.

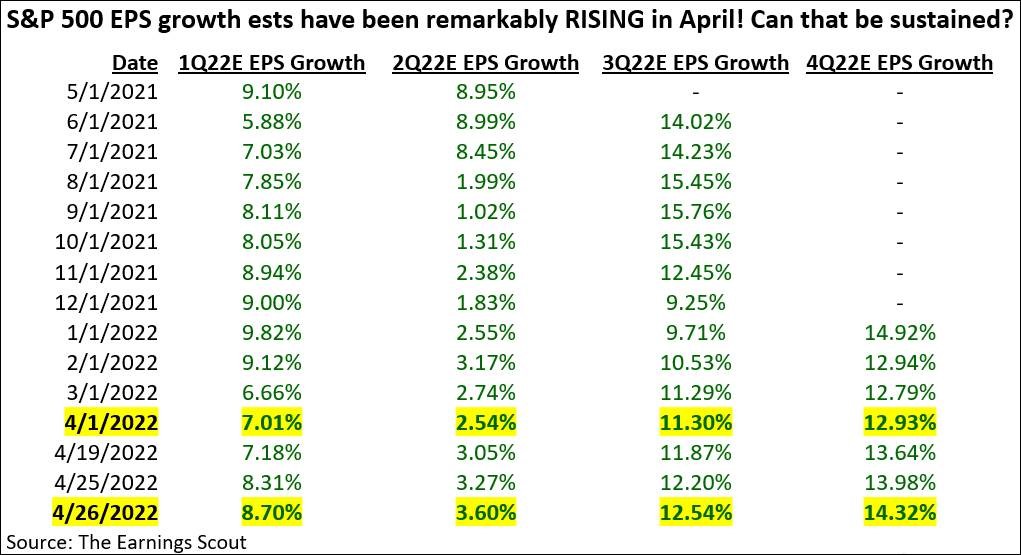

This chart below is from my good friend Nick Raich who runs www.EarningsScout.com.

The key points are highlighted in yellow. That being where the earnings growth outlook now is better than before the earnings season started. This is a statement that recent earnings announcements have been good. More importantly that analysts foresee even better results than previously anticipated in the quarters ahead.

Or to overly simplify…corporate earnings points to NO slowing of the economy. In fact, it shows an acceleration of growth.

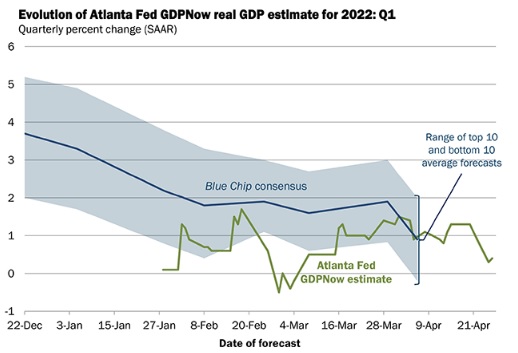

Unfortunately, the Atlanta Fed has many more inputs in their GDPNow model. Here is a chart of that going back a few months:

The green line represents the model which has flitted from slightly in the contraction territory to +1.5%. In fact, that higher view of things was on display just a week ago before the model tumbled closer to 0% the last few days. This likely corresponds with the 6% decline in the S&P week over week.

You will also note the blue line on this chart which represents the “Blue Chip Consensus”. This being a panel of economists they monitor to get an average forecast for the US economy. Note that was nicely higher a month ago and now coming in closer to +1%.

Here is the bad news. If the actual GDP report on Thursday morning comes out worse than these expectations, then we will probably find lower lows as risk of recession and bear market will have increased.

If, on the other hand, GDP proves to be better than these anemic expectations, then it should be a very bullish catalyst as investors breathe a sigh of relief.

The one wrinkle to the bear case is that any weakness found in the economy could actually be a positive for stocks.

SAY WHAT?

That’s because bad news for the economy is good news for changing the Feds tune on raising rates…which investors could actually applaud with a rally.

Yes, this is an overwhelming range of possibilities. And don’t want to venture a guess as to what will actually happen. The best we can do is review things in real time and make any adjustments.

Right now, we are pretty well geared for continuation of the bull market. So not much will change with our portfolio in that situation besides putting our modest 7% cash position to work in the market.

Now let’s imagine it’s a bad report, and odds of recession and further downside have increased, then we will start making more defensive moves. This would entail selling our most aggressive/bullish positions and start raising cash and/or buying inverse ETFs to profit from that potential downward action.

The key to the above statement is “odds of downside”…not guarantee of downside. And thus our defensive moves will likely be bit by bit and not all at once given that the market can bounce at any time for any reason (as we have seen time and time again over our investing lifetimes).

If you want to end on a positive note, the American Association of Individual Investors survey of investor sentiment is screaming bearish…which is as bullish as it gets.

Meaning that history has shown that most investors are wrong about market direction. If they are all too giddily bullish…then time to sell. And if they are wetting their beds about a bear market on the horizon, as they are now, then very often that is a sign of a bounce ready to come.

Again, no one said this is going to be easy, but truly we are ready for whatever comes our way.

What To Do Next?

Discover my current portfolio of 9 hand picked stocks and 4 ETFs inside the Reitmeister Total Return portfolio that are perfect for this hectic market environment. The same portfolio that firmly beat the market last year and is doing so once again in 2022.

How is that possible?

The clue is right there in the name: Reitmeister Total Return

Meaning this service was built to find positive returns in all market environments. Not just when the bull is running full steam ahead. Heck, anyone can profit in that environment.

Yet when stocks are trending sideways, or even worse, heading lower…then you need to employ a different set of strategies to be successful.

Come discover what my 40 years of investing experience can do you for you.

Plus get immediate access to my full portfolio of 9 stocks and 4 ETFs that are primed to excel in this unique market environment. (This includes 2 little known investments that actually profit from rising rates which right now is the best trade in town).

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $421.28 per share on Wednesday afternoon, up $5.18 (+1.24%). Year-to-date, SPY has declined -11.03%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post April 28th is Pivotal Day for Stock Market appeared first on StockNews.com

Bulls and bears have been squabbling over the direction of the stock market (SPY) since the start of the year. Right now the bears are winning. But the bulls have not lost hope because the economy seems to be in fine shape. That may all change Thursday morning, April 28th when the GDP report comes out. This key announcement could truly be a catalyst in either direction. This commentary will get you ready for whatever comes our way on 4/28. Read on for more.

(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Stocks are retesting the lows established in late February before a glorious, but short lived, March bounce. On the surface we are dealing with the same elements as before: