Facebook (NASDAQ: FB) Soars And Wall Street Delights

A solid result was much needed, and Meta Platforms, Facebook’s (NASDAQ: FB) parent, certainly delivered.

This story originally appeared on MarketBeat

A solid result was much needed, and Meta Platforms, Facebook’s (NASDAQ: FB) parent, certainly delivered. Their Q1 earnings, released after yesterday’s closing bell, missed on revenue but beat on EPS. The former, though light against the consensus, was still up 6% year on year, while earnings came in at $2.72 against an expected $2.55.

With Microsoft (NASDAQ: MSFT) having done their part earlier this week to stem the tide of negativity sweeping across equity markets, investors would have been watching closely to see if the likes of Facebook would also defy the current risk-off sentiment that has sent indices down to their lowest point of the year.

Looking deeper into the numbers, net income declined just 21% versus expectations for a 24% drop, while in operating metrics, daily active users rose 4% to 1.96 billion, which topped expectations there. Ad impressions delivered across the “Family of Apps” (Facebook, Messenger, Instagram, WhatsApp) rose by 15% year-over-year, and the average price per ad fell by 8% in that span. CEO Mark Zuckerberg noted with the results that “we made progress this quarter across a number of key company priorities and we remain confident in the long-term opportunities and growth that our product roadmap will unlock.”

Off The Lows

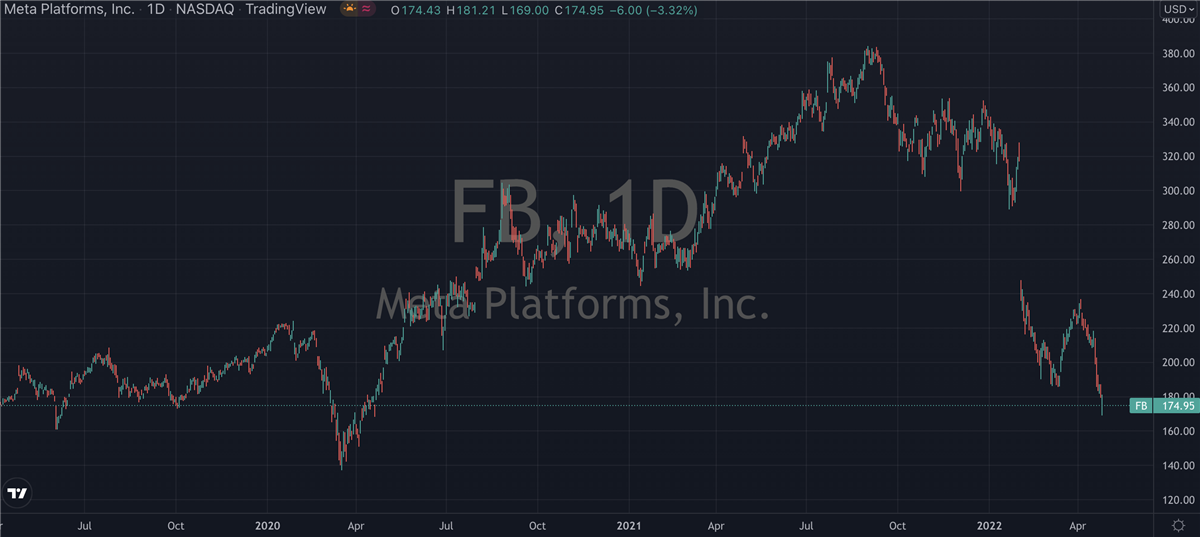

Facebook shares jumped close to 20% in the after-hours session and were holding those gains in Thursday’s pre-market. Interestingly, an erroneous headline from Bloomberg earlier on Wednesday had sent them sliding before they recovered into the close. It had taken them to fresh multi-year lows, indeed it was their lowest level since just after the COVID pandemic started, and investors will be hoping the strong bid seen today will hold true into the weekend. They’re still down more than 50% from last year’s all time high, making them one of the worst-performing of the FAANG group of tech stocks.

A combination of factors like rising interest rates, soaring inflation, and the Russian invasion of Ukraine have combined to hurt almost every stock out there, but in particular tech stocks. It could well be the case that it will take a while to top last year’s high, but that’s not to say there isn’t money to be made by investors in the meantime.

Looking at the quarter ahead, Facebook is guiding Q2 revenues of between $28 billion and $30 billion, just shy of consensus for $30.69 billion. That’s due to a “continuation of the trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine,” as well as expectations that currency changes would provide a 3% headwind.

It seems that they’ve managed to put their more recent earnings reports behind them, at least for now. For those of us with a short memory, Facebook broke a six-quarter streak of beating expectations on top and bottom lines in the third quarter of last year, when it missed revenue consensus – and then in Q4 it missed on net earnings estimates, leading to a next-day decline of more than 26%, the biggest single-day equity value wipeout ever. They’re still struggling to successfully navigate the new landscape of user privacy, brought about by changes Apple (NASDAQ: AAPL) introduced last year. It’s thought these could cost Facebook upwards of $10 billion in lost ad revenue this year alone.

Getting Involved

Notwithstanding the post earnings jump we’re seeing today, there are some who see more tough times ahead for Facebook. KeyBanc recently suggested that new macro pressures (including advertising impact from war) and high inflation would stress ad budgets, and more diversified names would benefit, while e-commerce end product will be a headwind for them.

But for investors thinking about getting involved, this actually isn’t a bad time to dip the toe in. There’s a super easy exit point to work off at the $170 mark, as any sustained move below there would put paid to any hopes for a recovery. To the upside, the bulls will be thinking that the worst case scenarios are already priced in, and in a way, it can only get better for Facebook from here.

Meta Platforms is a part of the Entrepreneur Index, which tracks some of the largest publicly traded companies founded and run by entrepreneurs.

A solid result was much needed, and Meta Platforms, Facebook’s (NASDAQ: FB) parent, certainly delivered. Their Q1 earnings, released after yesterday’s closing bell, missed on revenue but beat on EPS. The former, though light against the consensus, was still up 6% year on year, while earnings came in at $2.72 against an expected $2.55.

With Microsoft (NASDAQ: MSFT) having done their part earlier this week to stem the tide of negativity sweeping across equity markets, investors would have been watching closely to see if the likes of Facebook would also defy the current risk-off sentiment that has sent indices down to their lowest point of the year.

Looking deeper into the numbers, net income declined just 21% versus expectations for a 24% drop, while in operating metrics, daily active users rose 4% to 1.96 billion, which topped expectations there. Ad impressions delivered across the “Family of Apps” (Facebook, Messenger, Instagram, WhatsApp) rose by 15% year-over-year, and the average price per ad fell by 8% in that span. CEO Mark Zuckerberg noted with the results that “we made progress this quarter across a number of key company priorities and we remain confident in the long-term opportunities and growth that our product roadmap will unlock.”