3 Reasons Tesla Is Looking Tired And Toppy

Tesla (TSLA) looks to have stalled after a red-hot rally.

This story originally appeared on StockNews

Tesla (TSLA) looks to have stalled after a red-hot rally.

I recently appeared on Business First AM talking about Tesla and how to best trade it. The link to watch is below.

Also tweeted earlier on the very same subject.

https://twitter.com/Delta_Desk/status/1810397795129729245/photo/1

Here are the three reasons I felt that the torrid Tesla stock take-off was due to run out of power and need a recharge.

Valuations

It is well known that Tesla trades at ridiculous valuation multiples. Forward P/E is still hovering around 100x.

Rather than discuss traditional valuation metrics, I thought it would be interesting to price out valuation using the recent delivery numbers reported in early July.

Deliveries were 443,956 in Q2 versus expectations of 439,302. So, a beat of 4653 vehicles. Yet Tesla rose 30% on the news, adding on just over $200 billion in market cap.

This equates to roughly $43 million per car based on the delivery beat of 4653 vehicles.

Another delivery metric compares the expected deliveries of 1.7 million vehicles in 2024 versus the market cap of $830 billion with the stock trading at the recent highs of $265.

This values each car produced at just over $480,000. Certainly, a fairly frothy number indeed.

Technicals

Tesla stock once again failed to break past the $265 resistance level following the recent red-hot rally.

Shares reached the most overbought readings technical levels in the past year. 9-day RSI reached 92 before weakening. MACD also hit an extreme then softened. Bollinger Percent B printed at nearly 130 then reversed to close well under 100. Shares traded at the biggest premium to the 20-day moving average over the prior 12 months.

Previous times TSLA reached even close to this overbought marked significant short-term tops in the shares.

Option Prices

Implied volatility (IV) is near the highest levels of the year in TSLA options. Some of the IV pop is undoubtedly due to the impending earnings in a few weeks. But the only time in the past year that implied volatility was this elevated was when TSLA stock was trading under $140 last April prior to the last earnings release.

Normally a stock rising over 100 points would cause IV to generally lessen dramatically.

A quick comparative to the previous time Tesla was trading at a similar price to the current price at a similar time before earnings will shed some light.

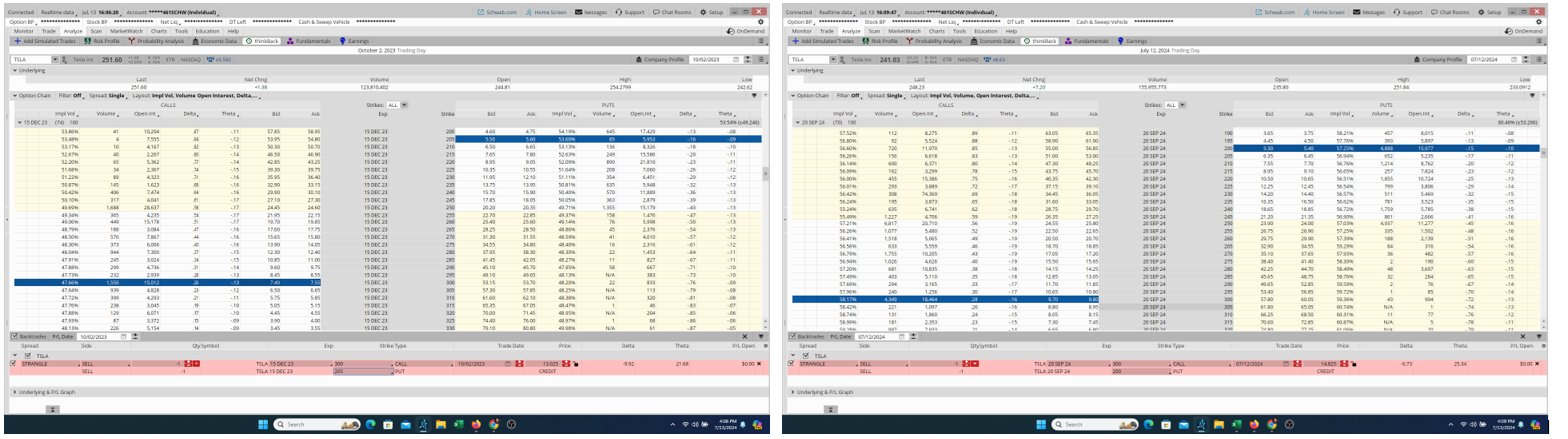

Below are two option montages. One from 10/2/2023 and the second from Friday-7/12/2024.

On 10/2/2023 TSLA stock closed at $251.60. The December $300 calls were priced at $7.50 with 74 days until expiration.

Friday, TSLA stock closed at $248.23. The September $300 calls went out at $9.75 with 70 days left until expiration.

So, even with TSLA stock at a lower price and with less days to go until expiration, the $300 calls are currently trading higher by $2.25-or 30%.

Why? Because implied volatility (IV) has risen sharply from under 48 last October to over 58 now.

Also note that the IV on the $300 calls versus similarly distant out-of-the-money puts (called the “skew”) has flattened considerably.

Last October, with TSLA at $251.60, the IV on the December $300 calls compared to the December $205 puts was 1.12 (53.6 IV on the puts divided by 47.66 IV on the calls).

This is normally the case with puts carrying a higher IV than similar calls.

Currently, though, the calls are actually trading with a slightly higher IV than the puts.

TSLA closed at $248.23 Friday. The September $300 calls closed at a 58.17 IV while the similarly out-of-the money September $200 puts went out with a 57.25 IV. The skew is now under 1.00-trading at .98.

Such increased demand for calls is also a reliable contrarian indicator. The speculative fervor for upside exposure in TSLA stock has made call prices very expensive-both on an absolute and comparative basis.

This favors call selling strategies that I talked about in the video mentioned at the beginning of this article.

Of course, no one knows the future of Tesla stock. Trading is about probabilities, not certainties.

But traders and investors alike may want to consider some form of call selling in their trade structuring to take advantage of what is normally a temporary pop in TSLA IV.

This is the type of analysis we do day in and day out at POWR Options.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

TSLA shares closed at $248.23 on Friday, up $7.20 (+2.99%). Year-to-date, TSLA has declined -0.10%, versus a 18.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post 3 Reasons Tesla Is Looking Tired And Toppy appeared first on StockNews.com

Tesla (TSLA) looks to have stalled after a red-hot rally.

I recently appeared on Business First AM talking about Tesla and how to best trade it. The link to watch is below.

Also tweeted earlier on the very same subject.