Applied Materials Stock is a Chip Shortage Recovery Play

Semiconductor equipment maker Applied Materials (NASDAQ: AMAT) stock went parabolic from November 2020 more than doubling and undeterred by the meltdown of the Nasdaq 100.

This story originally appeared on MarketBeat

Semiconductor equipment maker Applied Materials (NASDAQ: AMAT) stock went parabolic from November 2020 more than doubling and undeterred by the meltdown of the Nasdaq 100. Shares eventually hit all-time highs of $143 on April 5, 2021. The Company is a pandemic and post-pandemic benefactor as the demand for semiconductors have outstripped supply causing many top-tier companies to cut their guidance. From the auto sector to consumer electronics, the global chip shortage underscored how fragile the supply chain is when 80% of the world’s semiconductors are manufactured by just two foreign companies, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung Electronics (OTCMARKETS: SSLNF). Applied Materials counts them both as well as Intel (NASDAQ: INTC) as key customers. They are also plugged into next-gen technologies ranging from solar, personalized medicine, artificial intelligence (AI), machine learning, big data analytics, virtual reality (VR), internet of thing (IoT), autonomous vehicles, advanced displays, 3D printing and smart devices. The Company has a dominant position in supplying the vital technology, equipment and software needed to produce semiconductors with the immediate heavy demand to combat the shortage. Prudent investors seeking to invest in a direct beneficiary of the chip shortage can track shares of Applied Materials for opportunistic pullback levels.

Q1 Fiscal 2021 Earnings Release

On Feb. 18, 2021, Applied Materials reported its fiscal Q1 2021 results for the quarter ending January 2021. The Company reported earnings-per-share (EPS) of $1.39 versus consensus analyst estimates for $1.28, an $0.11 beat. The Company reported non-GAAP adjusted gross margin of 45.9%, operating income of $1.5 billion or 29% of net sales. Revenues grew 24% year-over-year (YoY) to $5.16 billion, beating analyst estimates for $4.97 billion. Applied Materials generated $1.42 billion in cash from operations and paid out $201 million in dividends to shareholders.

Raised Q2 Fiscal 2021 Guidance

The Company raised fiscal Q2 2021 EPS to a range between $1.44 to $1.56 versus $1.28 analyst estimates. The Company sees Q2 2021 revenues between $5.37 billion to $5.41 billion versus $4.97 consensus analyst estimates. On April 5, 2021, the Semiconductor Industry Association reported that global chip sales rose 14.7% YoY to $39.6 billion in February 2021.

Conference Call Takeaways

Applied Materials CEO, Gary Dickerson, set the tone, “Cloud service providers are forecasting data center CapEx growth of more than 15% this year on top of record spending in 2020.With broader adoption of 5G handsets, silicon content in smartphones is growing at double-digit rates. And in automotive, where there are known supply shortfalls, total semi consumption is expected to expand more than 15% this year, translating these factors to industry investments.” CEO Dickerson expects DRAM investments to outgrow NAND this year adding up to strong demand for wafer fab equipment that will sustain itself way beyond 2021. Digital transformation is nondiscretionary and applies to every part of the economy, driving demand for wafer fab equipment. Semiconductor Systems is expected to be up 50% YoY at mid-point Q2 guidance. PVD business is expected to grow more than 40% YoY generating over $3 billion. Optical wafer inspection and e-beam products, which are still in early adoption stages, are expected to generate up to 50% YoY growth.

Investor Day Company Update

On April 7, 2021, Applied Materials provided three-year performance and strategy guidance at its Investor Day. The Company expects to generate 70% of its future parts and services revenues implementing a subscription-like long-term agreements model. For fiscal 2024, the Company expects to grow revenues over 55% and non-GAAP EPS by over 100% compared to fiscal 2020. Semiconductor Systems revenue is expected to improve by over 60%. The Company expects to return 80% to 100% of free cash flow to shareholders. Applied materials expects grow its services business by over 45% as it migrates towards a subscription model expanding the use of digital services and remote capabilities utilizing sensors and AI analytics.

AMAT Opportunistic Pullback Levels

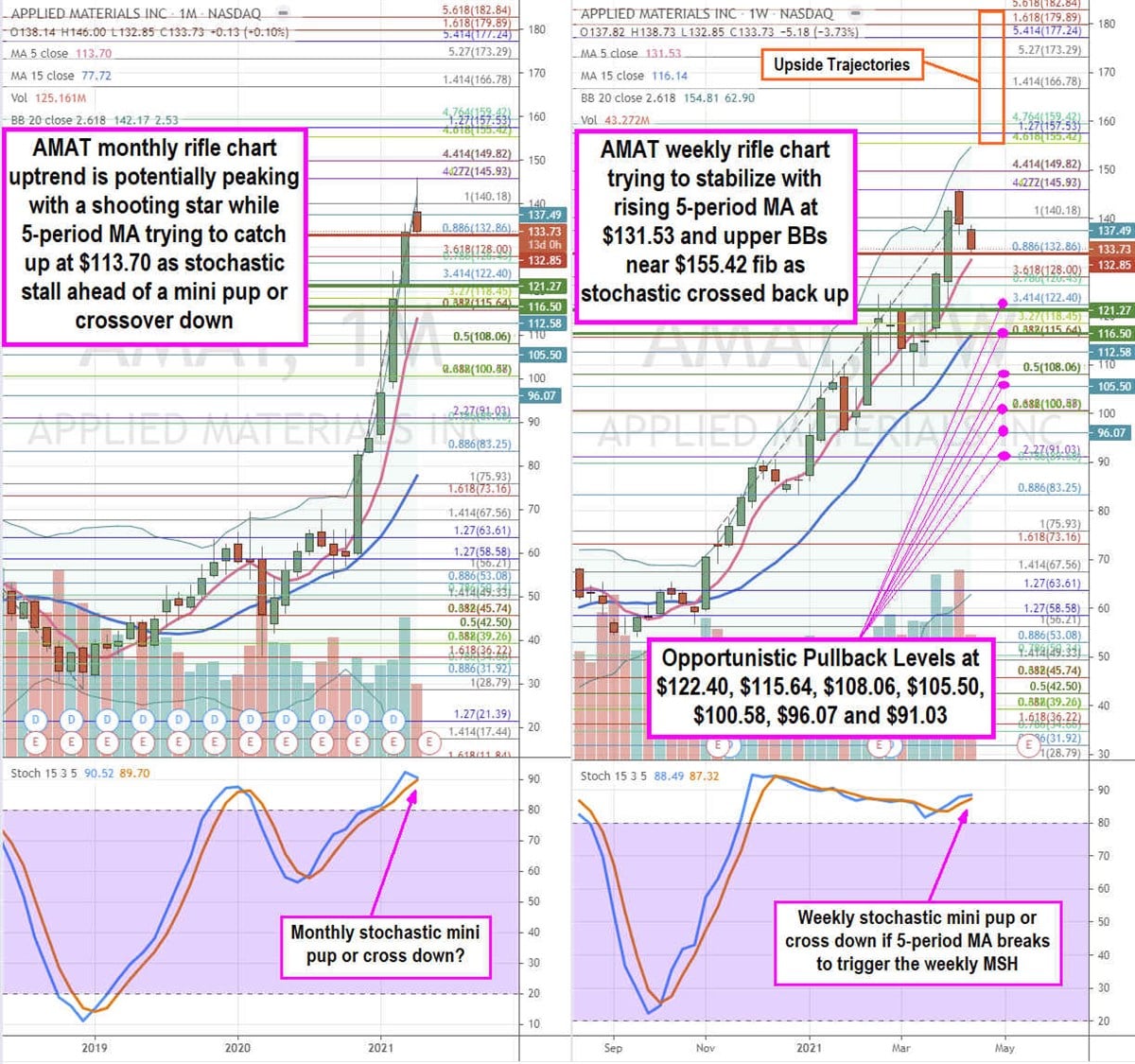

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for AMAT shares. The monthly rifle chart went parabolic squeezing up to the $145.93 Fibonacci (fib) level. The monthly uptrending may be stalling as a shooting star candle takes shape. The monthly 5-period moving average (MA) is still rising at $113.70, while the stochastic stalls out at the 90-band to either mini pup or crossover back down. Shares briefly overshot through the monthly upper Bollinger Bands (BBs) at $142.17 before pulling back down. The weekly rifle chart is uptrending with a rising 5-period MA at $131.53 powered by the weekly market structure low (MSL) buy trigger on the breakout through $121.27. The weekly stochastic stalled at the 90-band to set-up either a mini pup towards the weekly upper BBs near the $155.42 fib or a channel tightening towards the 15-period MA on a stochastic cross down which can trigger on a breakdown of the market structure high (MSH) trigger below $133.73. This can result in a steep reversion setting up opportunistic pullback levels at the $122.40 fib, $115.64 fib, $108.06 fib, $105.50 fib, $100.58 fib, $96.07 fib, and the $91.03 fib. The upside trajectories range from the $155.42 fib up towards the $182.84 fib level. Keep an eye on peers KLA Corporation (NASDAQ: KLAC) and Lam Research (NASDAQ: LRCX) stocks as they tend to move together.

Featured Article: What is Elliott Wave theory?

Semiconductor equipment maker Applied Materials (NASDAQ: AMAT) stock went parabolic from November 2020 more than doubling and undeterred by the meltdown of the Nasdaq 100. Shares eventually hit all-time highs of $143 on April 5, 2021. The Company is a pandemic and post-pandemic benefactor as the demand for semiconductors have outstripped supply causing many top-tier companies to cut their guidance. From the auto sector to consumer electronics, the global chip shortage underscored how fragile the supply chain is when 80% of the world’s semiconductors are manufactured by just two foreign companies, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung Electronics (OTCMARKETS: SSLNF). Applied Materials counts them both as well as Intel (NASDAQ: INTC) as key customers. They are also plugged into next-gen technologies ranging from solar, personalized medicine, artificial intelligence (AI), machine learning, big data analytics, virtual reality (VR), internet of thing (IoT), autonomous vehicles, advanced displays, 3D printing and smart devices. The Company has a dominant position in supplying the vital technology, equipment and software needed to produce semiconductors with the immediate heavy demand to combat the shortage. Prudent investors seeking to invest in a direct beneficiary of the chip shortage can track shares of Applied Materials for opportunistic pullback levels.

Q1 Fiscal 2021 Earnings Release

On Feb. 18, 2021, Applied Materials reported its fiscal Q1 2021 results for the quarter ending January 2021. The Company reported earnings-per-share (EPS) of $1.39 versus consensus analyst estimates for $1.28, an $0.11 beat. The Company reported non-GAAP adjusted gross margin of 45.9%, operating income of $1.5 billion or 29% of net sales. Revenues grew 24% year-over-year (YoY) to $5.16 billion, beating analyst estimates for $4.97 billion. Applied Materials generated $1.42 billion in cash from operations and paid out $201 million in dividends to shareholders.