My Startup Couldn't Raise VC Funding, So We Became Profitable. Here's How We Did It — And How You Can Too.

Four months ago, my startup reached profitability for the first time. It came after more than a year of active work and planning, and here's what it took.

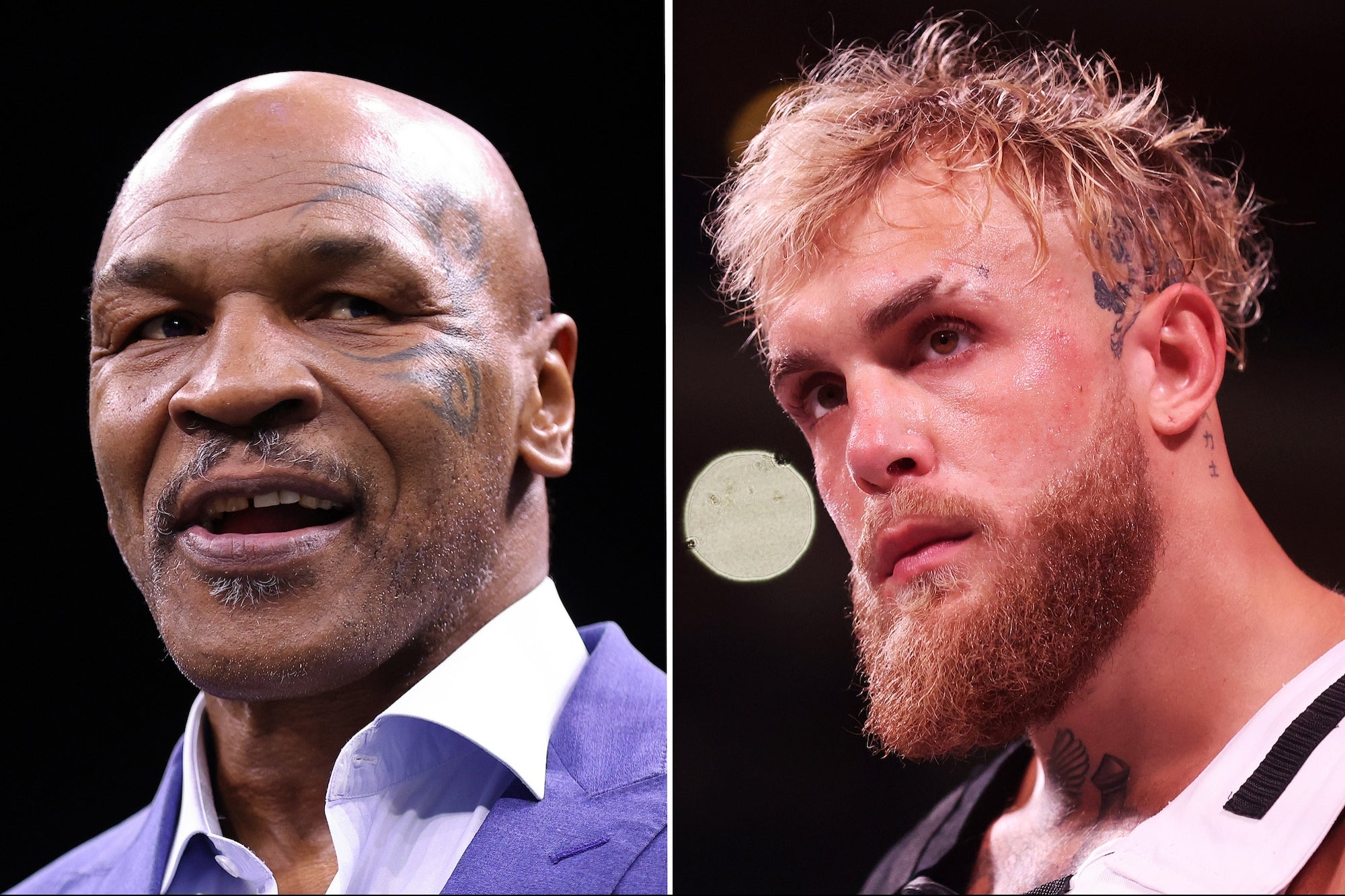

Jake Paul, Mike Tyson Selling $2 Million Ticket Packages Ahead of Netflix Fight — Here's What It Includes

It's a VIP package that comes with some major perks.

Jack Dorsey Explains Bluesky Exit: 'Literally Repeating All the Mistakes We Made' at Twitter

Dorsey left the Bluesky board and deleted his account earlier this week.

Featured Voices

Become a featured writer on Entrepreneur by applying to join Entrepreneur Leadership Network >

Explore the 2024 Franchise 500Ⓡ List

Entrepreneur's 45th annual Franchise 500Ⓡ ranking shines a light on the unique challenges and changes that have shaped the franchise industry over the last year -- and how franchisors have adapted and evolved to meet them.

See the listBrowse Franchise By Category

If You Want to Make Millions, Ditch Your Polished Pitch and 'Own Your Crazy' Says This Legendary Branding Guru

Phyllis Williams-Strawder, the self-anointed "Ghetto Country Brandmother," shares her unfiltered thoughts on achieving big success by using your authentic voice.

How His Experience As a Teenage Father Fueled His Drive to Become a Successful Entrepreneur and Help Others

Entrepreneur and investor Kale Goodman shares his story of resilience and determination.

Don't Have Time to Eat Healthy? This Entrepeneur Has a Fix for That.

Luke Saunders, founder and CEO of Farmer's Fridge, built a company to make eating fresh food on the go as easy as buying a bag of chips.

AI Is Flooding Social Media. Here's How to Make Sure You Don't Get Lost in the Robotic Noise.

Content overload from AI is the new normal. Marketing guru Mari Smithen shares strategies for navigating the AI revolution and getting your messaging across.

Carousel

Carousel-

America's Favorite Mom and Pop Shops™

In partnership with Walmart Business, Entrepreneur’s editor in chief Jason Feifer goes on a cross-country road trip to visit thriving mom and pop shops and discover the keys to their success. -

The CEO Series

An original content series produced by Salvi. Each episode profiles a business leader and their respective business. The series provides a humanizing look into the CEOs personal story, mindset and their business and industry. -

Beyond Unstoppable

Hosted by bestselling author Ben Angel, Beyond Unstoppable is a transformative exploration into biology, psychology, and technology. -

Entrepreneur Elevator Pitch

Your favorite pitch show is back with new entrepreneurs pitching Entrepreneur's investors. -

Fix My Pitch

Led by pitch masters Anthony Sullivan and Tina Frey, former Entrepreneur Elevator Pitch contestants will workshop their weaknesses and hone their strengths with a team of business experts. -

Securing Your Success

Securing Your Success, a series that highlights small business success stories and the importance of connectivity within entrepreneurship, is sponsored by Comcast Business. -

Restaurant Influencers

Every week host and restaurant owner Shawn P. Walchef talks with leaders in restaurant and hospitality about their secrets to finding success with customers and growing a brand online. -

Jeff Fenster Show

Serial entrepreneur Jeff Fenster embarks on an extraordinary journey every week, delving into the stories of exceptional individuals who have defied the norms and blazed their own trails to achieve extraordinary success. -

No Drama Office

Working in an office can be crazy — but it doesn't have to be! In this new comedy series, watch as people learn to navigate the twists and turns that come with the nationwide return to the workplace. -

That Will Never Work

How many times have you been told “that will never work”? Probably not as often as Netflix co-founder Marc Randolph. The veteran Silicon Valley entrepreneur provides a healthy dose of humor, and actionable advice that will benefit founders - and would-be founders - at every stage of their business journey. -

Going Public

An original series streaming weekly where you can Click-to-Invest while you watch. THEIR JOURNEY. Your decision. -

How Brands Are Born

How Brands Are Born with Kristen Aldridge features the origin stories behind the world’s most impactful brands.

Entrepreneur TV is Available on

Your Favorite Apps

EntrepreneurTV offers original shows ranging from high-stakes investment, documentaries, behind-the-scenes looks at major brands, tips for starting your company and much more. 24hrs a day, 7 days a week.

Watch nowThe Franchise Show - Houston

2 Days Only! Meet Face to Face with Proven Businesses Proven, money making businesses that are now expanding in Houston are here to meet new potential owners. This is your only opportunity to meet with the hottest businesses face to face. Ask questions and get the information you need in a no pressure environment. Be there, find the businesses that excite you, shake hands and say hello!

Setting Your Business Up for Success in 2024

Join our panel of experts as they discuss the current economic landscape and what it means for businesses.

International Franchise Expo

Register for free to attend the leading franchise expo in the U.S. Meet 300+ franchise brands, attend sessions and network with industry experts.

Protect Your Business with This $50 Cyber Security Bundle

Featuring nearly 130 hours of content, this e-learning bundle can help you learn valuable IT concepts.

Elevate Your Mac's Productivity with This $30 License

MacPilot uses the power of UNIX to unlock hidden features in your Mac computer.

Get Exclusive Pricing on This Highly Rated Stock Market App with Special Savings Through May 12

Make wiser stock market moves with some innovative assistance.

To Make Your First Million Dollars, Draw Up This Venn Diagram: 'You Want to Fall Right In the Middle. If You Do, I Think It'll Take 5 Years'

The hosts of 'My First Million' believe anyone can make it happen if they follow this formula.

A Whole Foods Customer Told the Company's Founder: 'You're Just Not a Good CEO' — Here Was His Response

John Mackey has been doing things differently for a long time, and this is what he's learned.

After Going to Prison, He Worked Hard to Build a Career. Then This Happened, and He Discovered a Liberating Truth.

Steve's story illustrates that every action has two risks.

These Are the Most Diverse and Equitable Franchises in 2024

If you're looking for a diverse franchise family, these brands are a great place to start.