An Unusual Covered Call Opportunity in ERIC Stock

Why buying beaten down stocks like ERIC and selling expensive call options in a covered call trade will outperform with less risk.

This story originally appeared on StockNews

Why buying beaten down stocks like ERIC and selling expensive call options in a covered call trade will outperform with less risk.

The news from February 16 that Ericcson may have paid bribes to Isis in Iraq sent the stock plunging. Shares dropped 40% from the $12.50 level before finally bottoming out around the $7.50 area.

The drop took shares to levels last seen at the beginning of the Covid Crisis. The drop also took ERIC to extremely oversold readings from a technical perspective. 14-day RSI was slammed to under 20. MACD reached the most bearish levels in the past two years. Momentum nearly fell off the chart. Shares were at a massive discount to the 20-day moving average. The technicals, however, have improved greatly over the past few weeks.

Ericsson (ERIC – Rated “B”- Buy) has since recovered some of those big losses and closed Friday at about a dollar off the lows at $8.52. Some big-time player is thinking that ERIC stock has more room to run if the options market is any indication.

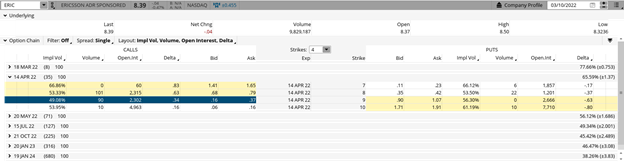

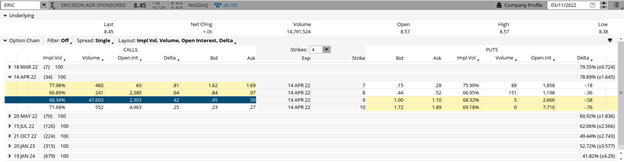

Friday saw very heavy unusual call buying in the ERIC April $9 calls. Unusual call buying is characterized by much larger than normal volume that dwarfs the open interest and spikes the implied volatility (or IV). Implied volatility is just another way to say the price of the option.

Over 47,000 contracts traded Friday in the April $9 calls. Compare that to volume on Thursday of just 90 contracts. Certainly, unusual volume.

Thursday Option Montage

Friday Option Montage

These 47,000 contracts were versus just 2,303 open interest. Open interest indicates the total number of option contracts that still open, or still waiting to be closed out. The fact that the volume was over 16 times the size of the open interest is a clear indication it was fresh, new buying.

More importantly, the implied volatility (IV) of the option jumped from under 50 on Thursday before the massive call buying to over 68 after the big-time call buyer stepped in. This means that the price of the option exploded. In fact, IV now stands at the 100th percentile. Option prices have not been this expensive in the past year.

The April $9 calls were up 20 cents even though the stock rose only 6 cents on Friday. It makes no intuitive sense for the calls to rise more than the stock. This sets up ideally for a covered call trade to lean bullishly with the big call buying while capturing some very expensive option premium.

A covered call trade is executed by buying ERIC stock and then simultaneously selling 1 of the April $9 calls for each 100 shares of stock purchased.

The April $9 calls had a delta of 42 based on Friday’s close. This means that the April $9 calls were equivalent to 42 shares of ERIC stock. Buying 100 shares of ERIC stock and then selling 1 of the April $9 calls makes the overall net delta position 58 deltas net long (100 minus 42) or the same as owning 58 share of ERIC stock.

The cost of the trade is the price of the stock bought minus the price of the option sold. ERIC stock closed at $8.45 on Friday and the April $9 calls were trading around 47 cents. The total cost of the trade would have been $8.45 – $0.47 or just under $8.00.

Compare that to the cost of the trade before the big call buying. The cost of the trade based on Thursday’s closing prices would have been $8.39 for the stock and roughly 27 cents for the options. This equals $8.12 for the covered call trade.

So, the bullish covered call trade actually became about 14 cents cheaper even though ERIC stock rose 6 cents. This was because the big call buying made the options prices way more expensive.

The big call buyer had to overpay to put on that big of a trade. We can take advantage by selling those expensive options and then hedging with the stock.

Stocks are generally lower to start the year. The VIX, a measure of S&P 500 implied volatility, is higher on the year. The combination of lower stocks and higher options is a dual benefit to a covered call strategy.

Selling call options versus long stock positions can bring in additional money in the form of richer option premiums. The trade-off is that you give away some of the big upside in exchange for cushioning the downside and lowering your risk.

2022 is shaping up to be a year where overall market gains will likely come in much lower than the previous few years. Adding covered call strategies can help weather the storm and provide for out-performance even if stocks underperform.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

ERIC shares closed at $8.45 on Friday, up $0.06 (+0.72%). Year-to-date, ERIC has declined -22.26%, versus a -11.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post An Unusual Covered Call Opportunity in ERIC Stock appeared first on StockNews.com

Why buying beaten down stocks like ERIC and selling expensive call options in a covered call trade will outperform with less risk.

The news from February 16 that Ericcson may have paid bribes to Isis in Iraq sent the stock plunging. Shares dropped 40% from the $12.50 level before finally bottoming out around the $7.50 area.

The drop took shares to levels last seen at the beginning of the Covid Crisis. The drop also took ERIC to extremely oversold readings from a technical perspective. 14-day RSI was slammed to under 20. MACD reached the most bearish levels in the past two years. Momentum nearly fell off the chart. Shares were at a massive discount to the 20-day moving average. The technicals, however, have improved greatly over the past few weeks.