Is Dave & Buster’s Immune to High Inflation and Lower Spending?

Interactive entertainment restaurant operator Dave & Buster’s Entertainment (NASDAQ: PLAY) is proving that its possible to mitigate both inflationary pressures

This story originally appeared on MarketBeat

- Dave & Busters just reported record Q2 2022 revenues

- Dave & Buster’s seeks to generate $20 million to $25 million in cost savings

- The Company stated that consumers are spending at higher levels than seen in 2021

Interactive entertainment restaurant operator Dave & Buster’s Entertainment, Inc. (NASDAQ: PLAY) is proving that its possible to mitigate both inflationary pressures and weakening consumer spending. They completed the $835 million acquisition of Dallas-based food and games chain Main Event Entertainment on June 29, which has 50 locations. These are truly synergistic businesses that expand the reach of the core business. Main Event is geared more towards families and young children while Dave & Buster’s appeals more to the millennials and Gen-Xers. Together, Dave & Buster’s seeks to generate $20 million to $25 million in cost savings. More importantly, it adequately covers a full range of demographics from children to middle-aged customers. Keep in mind, Dave & Busters has been in business for four decades. While full-service restaurants like Brinker International (NYSE: EAT) and Darden Restaurants (NYSE: DRI) are feeling the margin compression stemming for a pullback in consumer spending, Dave & Busters continues to grow as the video games and entertainment helps offset pressure on the restaurant side. High inflation and waning consumer discretionary spend has yet to hit the top or bottom line for Dave & Busters as they just reported record Q2 2022 revenues and adjusted EBITDA. They shrugged off wage and commodity inflation with operational efficiencies and pricing actions as the Company already saw $11.5 million in annualized synergies to date. The Company stated that consumers are spending at higher levels than seen in 2021 and 2019.

Dave & Busters Immune to a Recession?

On Sept. 22, 2022, Dave & Buster’s released its second-quarter fiscal 2022 results for the quarter ending July 2022. The Company reported an earnings-per-share (EPS) profit of $0.59 excluding non-recurring items. Record revenues rose 24% year-over-year (YoY) to $468.4 million and beating consensus analyst estimates of $432.92 and 35.9% over 2019 pre-Covid levels. Total comparable sales at Dave & Buster’s branded stores rose 9.6% compared to same quarter 2019 pre-Covid era. Total comparable sales at Main Event branded stores increased 27% from June 29, 2022, to July 31, 2022, compared to Q2 2019. Operating income was negatively impacted by acquisition transaction costs, rising stock based compensation expenses, and an impairment charge.

Dave & Buster’s new CEO Chris Morris commented, “We experienced strong guest visitation and spending across both brands this quarter. Our teams continued to deliver high levels of service to our guests, while simultaneously beginning the process of integration into one company. I want to recognize the efforts of our combined teams as we work to capture the synergies from our combination and adopt best practices across our brands. While we saw substantial headwinds during the quarter from wage and commodity inflation, we remained focused on driving revenue and strong cash flow while still working to mitigate these pressures with operational efficiencies and appropriate pricing actions.”

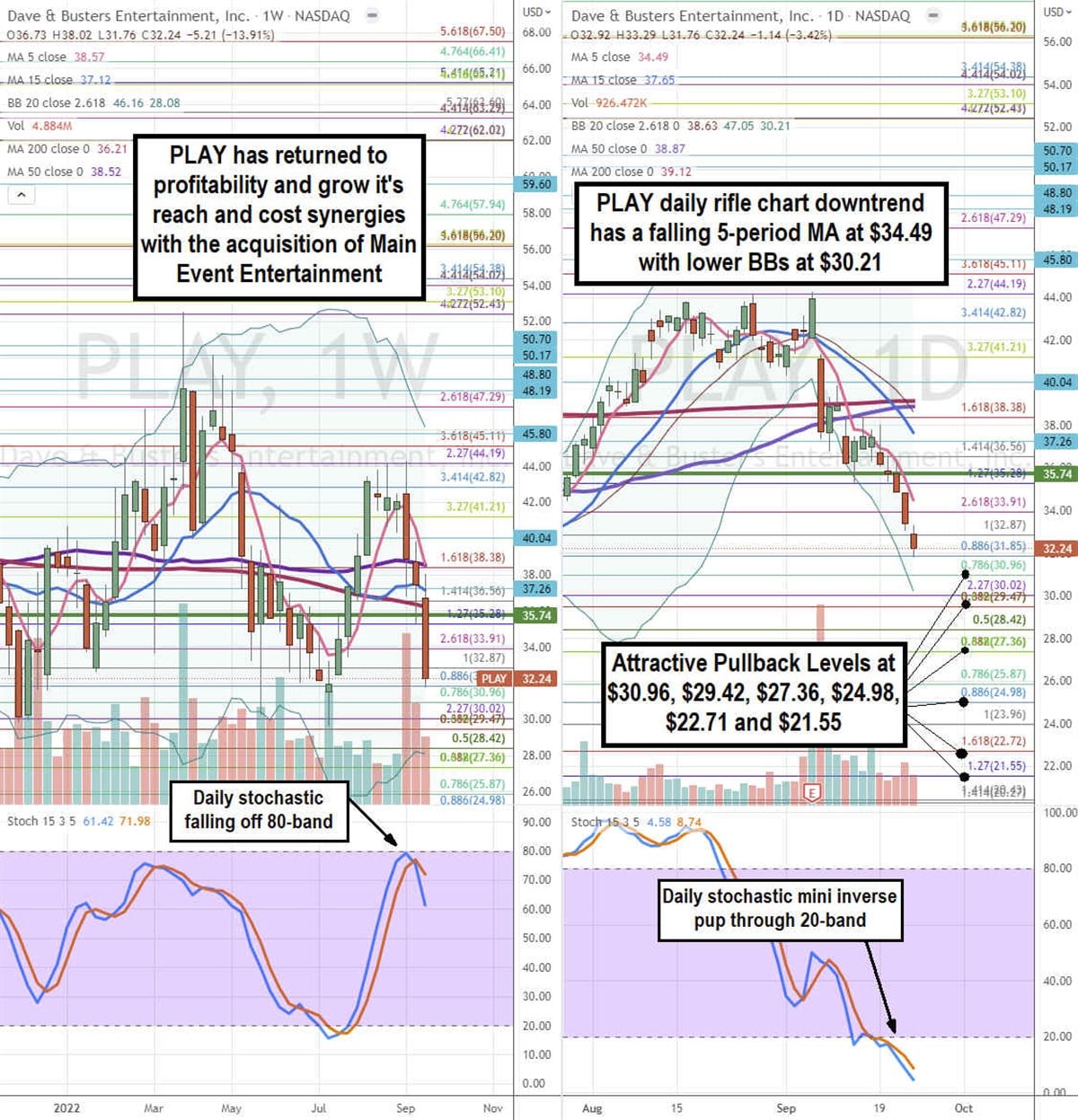

Dave & Busters Here’s What the Charts Say

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for PLAY stock. The weekly rifle chart peaked out a double top swing high near the $44.19 Fibonacci (fib) level. The weekly breakdown is starting to form as the weekly 5-period moving average (MA) at $34.49 falls towards the weekly 15-period MA at $37.45. The weekly 50-period MA sits near the $38.38 fib level. Shares collapsed through the weekly 200-period MA at $36.21 in a single candle. Shares also fell through its weekly market structure low (MSL) buy trigger at $35.74. The daily rifle chart shows the steep angle of the sell-off as shares are nearing its daily lower BBs at $30.21. The daily 5-period MA resistance is moving lower at $34.49 followed by the daily 15-period MA resistance at $37.65. The daily stochastic rejected the 20-band bounce attempt and turned into a bearish mini inverse pup falling through the 10-band. Attractive pullback levels sit at the $30.96 fib, $29.42 fib, $27.36 fib, $24.98 fib, $22.21 fib, and the $21.55 fib level.

Dave & Busters A Peek into a Strong Q3 Performance

Dave & Busters provided an early update on the first five-weeks of Q3 2022. Comparable store sales during the period rose 22% comprised of $17.6% at Dave & Busters and 42.3% at Main Event compared to the same five-week period in 2019. The Company is also planning on renovations that will optimize locations as large stores built 30-years ago are split into two stores in strategic locations conducive to accelerating growth.It’s D&B Loyalty program has grown to 4 million members since November 2021. Loyalty members account for higher visitation and 33% higher average guest check than non-members. The Company will also open 11 locations in the Middle East with sites in the Kingdom of Saudi Arabia and two other countries.

- Dave & Busters just reported record Q2 2022 revenues

- Dave & Buster’s seeks to generate $20 million to $25 million in cost savings

- The Company stated that consumers are spending at higher levels than seen in 2021

Interactive entertainment restaurant operator Dave & Buster’s Entertainment, Inc. (NASDAQ: PLAY) is proving that its possible to mitigate both inflationary pressures and weakening consumer spending. They completed the $835 million acquisition of Dallas-based food and games chain Main Event Entertainment on June 29, which has 50 locations. These are truly synergistic businesses that expand the reach of the core business. Main Event is geared more towards families and young children while Dave & Buster’s appeals more to the millennials and Gen-Xers. Together, Dave & Buster’s seeks to generate $20 million to $25 million in cost savings. More importantly, it adequately covers a full range of demographics from children to middle-aged customers. Keep in mind, Dave & Busters has been in business for four decades. While full-service restaurants like Brinker International (NYSE: EAT) and Darden Restaurants (NYSE: DRI) are feeling the margin compression stemming for a pullback in consumer spending, Dave & Busters continues to grow as the video games and entertainment helps offset pressure on the restaurant side. High inflation and waning consumer discretionary spend has yet to hit the top or bottom line for Dave & Busters as they just reported record Q2 2022 revenues and adjusted EBITDA. They shrugged off wage and commodity inflation with operational efficiencies and pricing actions as the Company already saw $11.5 million in annualized synergies to date. The Company stated that consumers are spending at higher levels than seen in 2021 and 2019.

Dave & Busters Immune to a Recession?

On Sept. 22, 2022, Dave & Buster’s released its second-quarter fiscal 2022 results for the quarter ending July 2022. The Company reported an earnings-per-share (EPS) profit of $0.59 excluding non-recurring items. Record revenues rose 24% year-over-year (YoY) to $468.4 million and beating consensus analyst estimates of $432.92 and 35.9% over 2019 pre-Covid levels. Total comparable sales at Dave & Buster’s branded stores rose 9.6% compared to same quarter 2019 pre-Covid era. Total comparable sales at Main Event branded stores increased 27% from June 29, 2022, to July 31, 2022, compared to Q2 2019. Operating income was negatively impacted by acquisition transaction costs, rising stock based compensation expenses, and an impairment charge.