Boeing Stock Is Still Working to Clear Pandemic-Related Turbulence

InvestorPlace – Stock Market News, Stock Advice & Trading TipsBA stock is still taking time to recover from the pandemic crash. Long-term investors are not wrong to have faith…

This story originally appeared on InvestorPlace

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

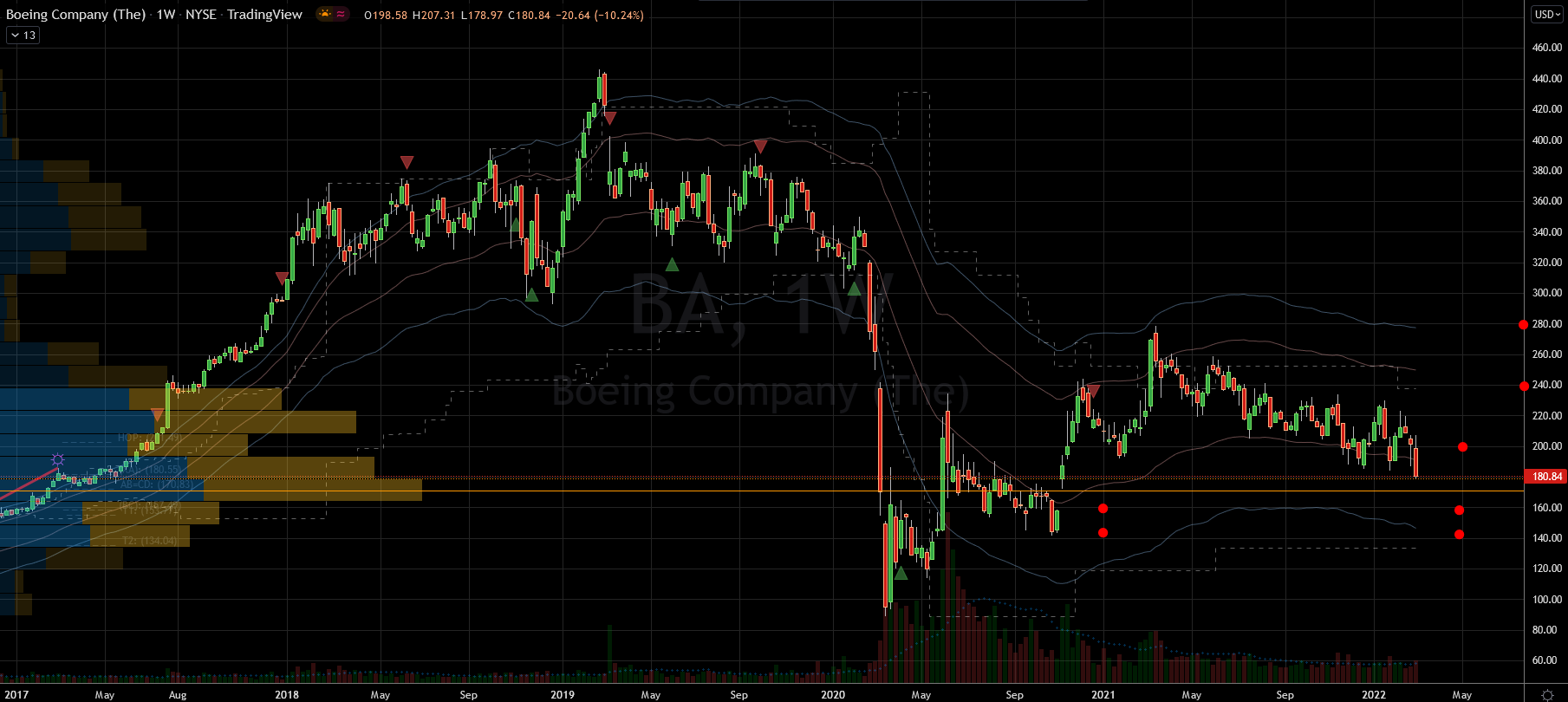

While equity markets are trying to deal with the new set of headlines, good stocks like Boeing (NYSE:BA) are struggling to find footing. First, consider that BA stock never really got out of the pandemic crater. It fell off the global lockdown cliff and it is still trying to claw back up.

In 2020, equities collapsed, including this one, but a few sectors like airlines are still suffering. In contrast, the indices bounced off of the March 2020 lows with ferocity. They broke out from the pre-pandemic lines and took off like a bat out of hell. BA’s clients — the airlines — still don’t have their feet under them.

I would argue that the laggards were more reasonable with their reaction out of March 2020. Way too many stocks rallied far too fast for their own good. This is the reason why the indices now are struggling to find footing. We took the fast way up and the pendulum has to swing the other way now.

Luckily for BA stock it doesn’t have too far to go below before hitting the pandemic lows. Therefore, part of my thesis is that dips are still buying opportunities for long-term investors. In the end, it is still a duopoly that will do well for decades. Meanwhile, there will be turbulence due to intrinsic and extrinsic factors.

Wall Street recently had two violent flash crashes. The first came on Jan. 24 about the time president and CEO of the Federal Reserve Bank of St. Louis James Bullard dropped his “tape bomb.” The second was exactly a month later on the war headline in the Ukraine.

Last week, BA stock broke through both levels violently. On Friday the stock fell 4% far more than the indices. I attribute this to the negative news escalating from the conflict in the Ukraine. Proof of this is that airline stocks like American Airlines (NASDAQ:AAL) fell 7%. While the market was red, these two fell disproportionately deeper.

The BA Stock Recovery Is Slow But Ongoing

The fundamentals for Boeing stock are still somewhat murky. Boeing has a special business being a duopoly, so it doesn’t have many sales problems. But its clients are in still in disarray.

Technically the chart is also showing cracks from several sources. First, BA stock lost support at $200 per share. This triggered a bearish pattern that could target $160 per share. There is still time to recover from this, but it better do so quickly. Second, there is a gap that was left open from the rally last November. The bears will try to shoot for that and will eventually act as support.

I see no reason why Boeing should revert to levels from the pandemic bottom, regardless of how bad things are now they are better than when earth closed for business. Hopefully the Russian invasion of the Ukraine will stop escalating.

Therein lies another assumption that investors need to make on that front. Mine is that the leaders will come to terms one way or another. We are still struggling to recover from a pandemic that killed 6 million people. Moreover, governments have spent trillions of dollars to inflate their economies to help aid their recovery.

Bottom Line on Boeing

At this stage, I trust my instincts and not the environment on Wall Street. As such, I suggest a humble approach to investing today. Don’t allow yourself to take full positions into anything regardless of how good it looks.

If you’re already long BA stock, don’t add to your position. New investors should also consider taking only partial positions. Leaving room to add more later is essential now. We have unpredictable politicians running the world everywhere, so I am uncertain if logic will pan out.

Meanwhile, if you want insurance, you can rely on the options markets.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

More From InvestorPlace

- Get in Now on Tiny $3 “Forever Battery’ Stock

- It doesn’t matter if you have $500 in savings or $5 million. Do this now.

- Stock Prodigy Who Found NIO at $2… Says Buy THIS

- Early Bitcoin Millionaire Reveals His Next Big Crypto Trade “On Air”

The post Boeing Stock Is Still Working to Clear Pandemic-Related Turbulence appeared first on InvestorPlace.

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

While equity markets are trying to deal with the new set of headlines, good stocks like Boeing (NYSE:BA) are struggling to find footing. First, consider that BA stock never really got out of the pandemic crater. It fell off the global lockdown cliff and it is still trying to claw back up.