Intel Stock is a U.S. Semiconductor Infrastructure Play

U.S. semiconductor developer Intel (NASDAQ: INTC) stock has staged a rally back towards its 2019 pre-pandemic highs to set-up a either a double-top or a breakout.

This story originally appeared on MarketBeat

U.S. semiconductor developer Intel (NASDAQ: INTC) stock has staged a rally back towards its 2019 pre-pandemic highs to set-up either a double-top or a breakout. With a long-awaited new CEO, Pat Gelsinger, installed and with plans to build chip fabrication (FABs) plants directly in the U.S. changes the narrative as a U.S. infrastructure play. This has bolstered sentiment and performance with shares out rising over 37% year-to-date (YTD), not only outperforming but lifting the Nasdaq 100. The Biden infrastructure package seeks to bolster U.S. supply chains from rare earth materials, clean energy to semiconductors. Considering 80% of the world’s semiconductor production is manufactured by two foreign companies, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung Electronics (OTCMARKETS: SSLNF). The rollout of it’s much delayed Ice Lake-SP chips and plans for Meteor Lake and new research collaboration with IBM (NYSE: IBM) indicates the reawakening of the sleeping giant. Prudent investors looking to get exposure in a U.S. semiconductor infrastructure play can monitor shares of Intel for opportunistic pullback levels.

Company Guidance Update

On March 23, 2021, Intel raised its Q1 2021 EPS guidance above its prior guidance for $1.10 versus consensus analyst estimates of $1.11. The Company sees it Q1 2021 quarterly revenues for the month ending in March 2021 exceeding the prior guidance of $17.5 billion versus $17.59 billion consensus analyst estimates. However, the Company trimmed full-year 2021 EPS guidance to come in around $4.55 versus consensus estimates for $4.74 and lowered full-year 2021 revenues to come in at approximately $72 billion versus $73.03 billion analyst estimates. While Q1 2021 strength was driven by continued strong notebook demand, the industry wide shortage of third-party components and entity list uncertainty was responsible for the trimming of estimates. CEO Gelsinger stated, “2021 is a transitional year as we accelerate Intel’s trajectory, invest in our future and improve out execution. We’re working aggressively with our supply chain partners and leveraging our unique manufacturing capabilities to solve for industry-wide component shortages and outperform this guide.”

IDM 2.0

On March 23, 2021, Intel CEO Pat Gelsinger, unveiled the Company’s integrated device manufacturing model known as IDM 2.0. The Company plans to construct two new fabs in Arizona at a cost of $20 billion. This will create 3,000 permanent high-tech, high wage jobs, over 3,000 construction jobs and approximately 15,000 local long-term jobs. Arizona Governor Doug Ducey and U.S. Secretary of Commerce Gina Raimondo participated in the IDM 2.0 event. CEO Gelsinger summed it up, “We are excited to be partnering with the state of Arizona and the Biden administration on incentives to spur this type of domestic investment.”

Intel Foundry Services

Intel plans to become a major player and provider of foundry capacity in the U.S. and Europe to serve customers globally. The newest fab, Fab 42, at its Ocotillo campus in Chandler, AZ, became fully operational processing 10nm chips in 2020. The two newly planned fabs will also reside at the Ocotillo campus with construction planned to commence later this year. The fabs will be part of a new standalone business, Intel Foundry Services (IFS), led by semiconductor veteran Dr. Randhir Thakur. The new business will differentiate itself from competitors offering process, packaging and committed capacity in the U.S. and Europe. Intel’s IP portfolio is available for customer including x86 cores, ARM and RISC-V ecosystem Ips. The Company has already received “strong enthusiasm and statements of support from across the industry.” The Company also expects to tape in the compute tile for its first 7nm client CPU, Meteor Lake, in Q2 2021. The downplaying of full-year 2021 guidance may be an attempt to set the bar low heading, however, the market is clinging to the infrastructure and turnaround narrative with extremely positive sentiment. Prudent investors will need to administer patience avoiding the urge to chase entries.

INTC Opportunistic Pullback Levels

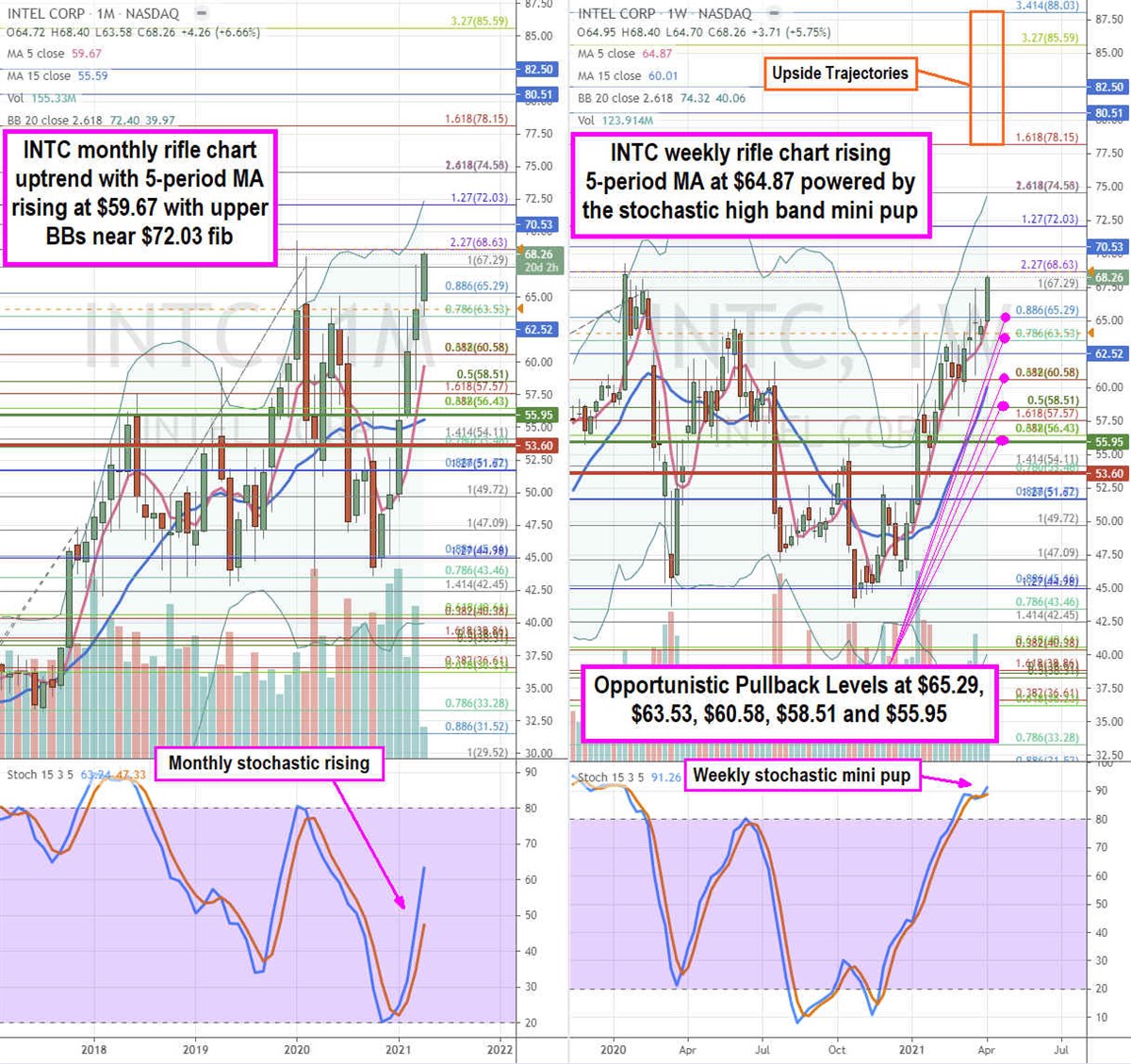

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for INTC shares. The monthly rifle chart is uptrending with a rising 5-period moving average (MA) support at $59.67 with monthly upper Bollinger Bands (BBs) near the $72.03 Fibonacci (fib) level. The monthly stochastic is still rising through the 60-band. The weekly rifle chart triggered a market structure low (MSL) buy trigger above $55.95, while the monthly market structure high (MSH) sell triggers under $53.60. The weekly rifle chart has an uptrend powered by a stochastic mini pup flushing shorts higher towards the weekly upper BBs near the $74.58 fib. Shares are nearing the pre-pandemic highs which will either form a double-top or a breakout. Prudent investors can monitor for opportunistic pullback levels at the $65.29 fib, $63.53 fib, $60.58 fib, $58.51 fib, and the $55.95 fib. The upside trajectories range from the $78.15 fib up towards the $88.03 fib level.

Featured Article: How is an ETF different from a mutual fund?

U.S. semiconductor developer Intel (NASDAQ: INTC) stock has staged a rally back towards its 2019 pre-pandemic highs to set-up either a double-top or a breakout. With a long-awaited new CEO, Pat Gelsinger, installed and with plans to build chip fabrication (FABs) plants directly in the U.S. changes the narrative as a U.S. infrastructure play. This has bolstered sentiment and performance with shares out rising over 37% year-to-date (YTD), not only outperforming but lifting the Nasdaq 100. The Biden infrastructure package seeks to bolster U.S. supply chains from rare earth materials, clean energy to semiconductors. Considering 80% of the world’s semiconductor production is manufactured by two foreign companies, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung Electronics (OTCMARKETS: SSLNF). The rollout of it’s much delayed Ice Lake-SP chips and plans for Meteor Lake and new research collaboration with IBM (NYSE: IBM) indicates the reawakening of the sleeping giant. Prudent investors looking to get exposure in a U.S. semiconductor infrastructure play can monitor shares of Intel for opportunistic pullback levels.

Company Guidance Update

On March 23, 2021, Intel raised its Q1 2021 EPS guidance above its prior guidance for $1.10 versus consensus analyst estimates of $1.11. The Company sees it Q1 2021 quarterly revenues for the month ending in March 2021 exceeding the prior guidance of $17.5 billion versus $17.59 billion consensus analyst estimates. However, the Company trimmed full-year 2021 EPS guidance to come in around $4.55 versus consensus estimates for $4.74 and lowered full-year 2021 revenues to come in at approximately $72 billion versus $73.03 billion analyst estimates. While Q1 2021 strength was driven by continued strong notebook demand, the industry wide shortage of third-party components and entity list uncertainty was responsible for the trimming of estimates. CEO Gelsinger stated, “2021 is a transitional year as we accelerate Intel’s trajectory, invest in our future and improve out execution. We’re working aggressively with our supply chain partners and leveraging our unique manufacturing capabilities to solve for industry-wide component shortages and outperform this guide.”