Walgreens Boots Alliance: Blue Chip, High-Yield Turnaround Story

Walgreens Boots Alliance is a high-yielding stock on the brink of a major turnaround that will drive growth for years to come.

This story originally appeared on MarketBeat

Walgreens Boots Alliance (NASDAQ: WBA) is an alluring buy, with the stock trading at only 7.5X earnings and paying more than 5.75% in yield. This combination is among the best in a blue chip stock, and the dividend is safe for now. The other story driving the value of this stock is the turnaround story. The turnaround story has been dragging on for years and still faces headwinds. The passing of COVID is a significant headwind that has cut deeply into the bottom line. However, the takeaway from the Q2 report is promising. The company is about to lap the worst of the COVID comparisons and is on track to begin growing earnings again.

“WBA exited a solid second quarter with acceleration in February, adding to our confidence in driving strong growth in the second half of the year. With the closing of VillageMD’s acquisition of Summit Health, WBA is now one of the largest players in primary care, with best-in-class assets across the care continuum … We will continue to take bold actions to create sustainable long-term shareholder value,” said CEO Rosalind Brewer.

Walgreens Has Good Quarter Despite Headwinds

Walgreens had an excellent Q2 despite the drag of declining COVID activity on the business. The company reported $34.9 billion in net revenue for a gain of 3.3% over the last year. The revenue beat the consensus figure by 50 basis points, including the impacts of FX. On a segment basis, US Retail Pharmacy was the weakest with a -0.3% decline due to a -1.8% decline in retail sales. The International segment saw a robust 9% organic increase, 1.6% after FX conversion, and the US Health segment was even more substantial. US Health grew more than double due to acquisition and is nearly 5% of the business.

Margin is a mixed bag of news, with GAAP results negative and adjusted results positive. The reason is one-off charges related to opioid settlements, the acquisition of Summit Health and restructuring are at play. Those aside, the company’s strong FCF can sustain the dividend.Regarding the earnings, adjusted EPS of $1.16 is down 27% YOY, but 26% is due to COVID. The more important detail is that EPS beat by a nickel, and the guidance is positive.

Walgreens is expecting full-year adjusted EPS of $4.45 to $4.65 compared to the $4.50 expected by the analysts. The company is forecasting earnings growth in the mid-20% for the 2nd half because of momentum in core operations and the passing of tough comps relative to last year. These figures include expected investment which should help sustain growth into the following year.

Analyst Predict Rebound For Walgreens Share Price

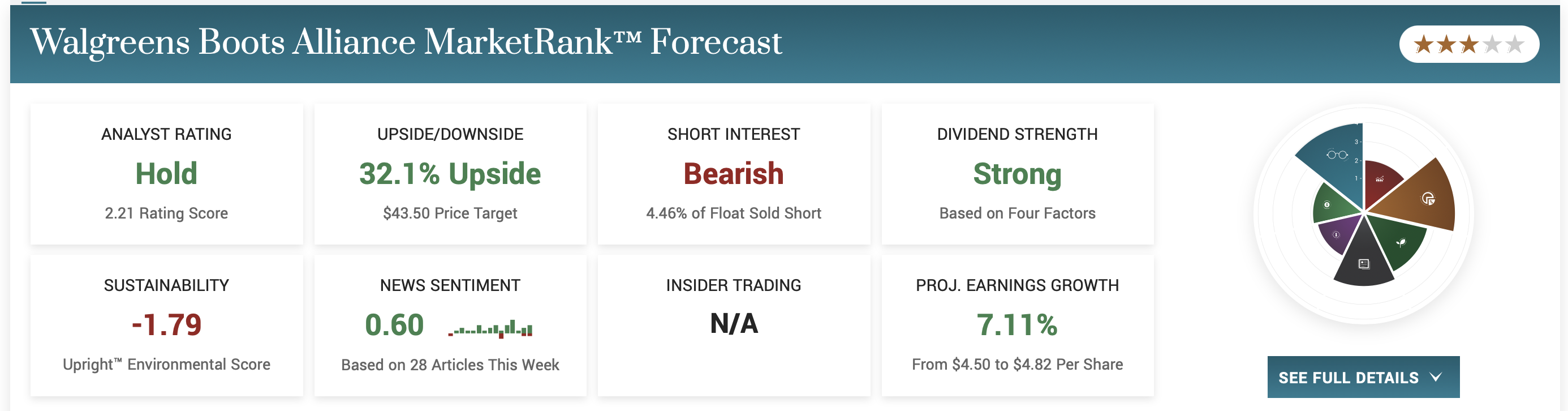

The analysts have trimmed their estimates for the last year, but the trend has ended. Marketbeat hasn’t picked up any new reports yet, but the consensus target hit bottom last quarter and has trended flat since then. The point is that consensus is about 30% above the current price action and has the stock trading at the top of a range and in a position to break out, given the proper catalyst.

Walgreens Boots Alliance (NASDAQ: WBA) is an alluring buy, with the stock trading at only 7.5X earnings and paying more than 5.75% in yield. This combination is among the best in a blue chip stock, and the dividend is safe for now. The other story driving the value of this stock is the turnaround story. The turnaround story has been dragging on for years and still faces headwinds. The passing of COVID is a significant headwind that has cut deeply into the bottom line. However, the takeaway from the Q2 report is promising. The company is about to lap the worst of the COVID comparisons and is on track to begin growing earnings again.

“WBA exited a solid second quarter with acceleration in February, adding to our confidence in driving strong growth in the second half of the year. With the closing of VillageMD’s acquisition of Summit Health, WBA is now one of the largest players in primary care, with best-in-class assets across the care continuum … We will continue to take bold actions to create sustainable long-term shareholder value,” said CEO Rosalind Brewer.