Are These Meme Stocks Going To Blow Up Again?

But as equity markets, in general, turn higher after a sluggish few months in the meantime, it looks like there’s a fresh fire being lit underneath stocks that have above average short interest. Here are three that are worth keeping a close eye on

This story originally appeared on MarketBeat

A quick look at any financial headlines this week makes it clear that there’s a buying frenzy kicking off in the world of meme stocks once again. They grabbed both Wall Street’s and Main Street’s attention for a couple of weeks in January as double and triple percentage daily moves became the norm but then they seemed to fade away almost as quickly as they appeared.

But as equity markets, in general, turn higher after a sluggish few months in the meantime, it looks like there’s a fresh fire being lit underneath stocks that have above average short interest. Here are three that are worth keeping a close eye on.

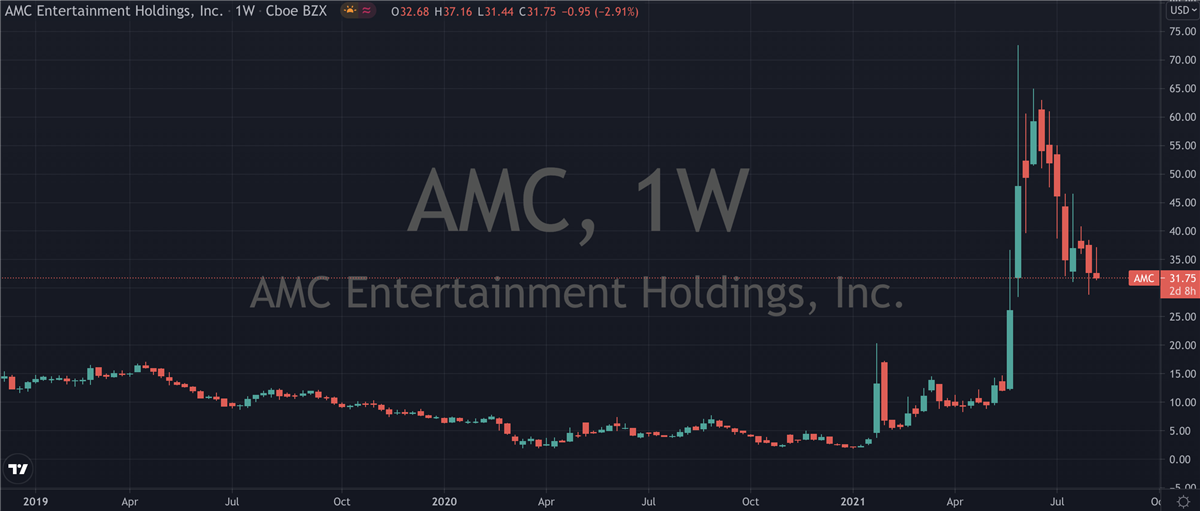

AMC Entertainment Holdings (NYSE: AMC)

With as much as a 500% pop in the past week, AMC is currently the hottest of them all. It has a ways to go before it can top the 800% rally it posted in January, but what’s interesting here is that the share price is already three times higher than that previous high.

There’s an argument to be made that as we approach a complete economic reopening and recovery that the likes of AMC and their cinema business stand to do very well, but that certainly can’t claim all the glory for this most recent run. The stock’s short interest has kept it at the forefront of the minds of retail traders, many of whom crowd source their buying strategies on online forums.

AMC’s management must be thanking their lucky stars as they take advantage of the higher share price to raise some much needed fresh capital. But for all the excitement it’s important to remember that there are no fundamentals justifying this move.

GameStop (NYSE: GME)

Though shares of GameStop gave back 90% of their value after the January mania died down, they surprised many by refusing to return to their pre-short squeeze levels. Instead, they stubbornly insisted on trending upwards to the point where they’ve now spent much of the past four months trading more than 800% higher than their December 2020 average.

Like with AMC, the risk-on sentiment that has returned to equities in recent weeks has brought fresh optimism to GME, and their stock has more than doubled since the middle of May. Just as it was looking like it was going to mature and trade a normal daily range indefinitely, that’s been blown right open and we could be looking at a repeat of what happened on January 28th.

Koss (NASDAQ: KOSS)

One thing is for sure, the fiscal Q3 earnings report from headphone manufacturer Koss isn’t the reason behind the 150% move seen in their shares over the past week. EPS was firmly in the red while revenue was 17% on the year, but still that hasn’t stopped them becoming a darling of the meme stock traders who have been piling into shares in recent sessions.

Daily traded volume numbers have yet to match those from the start of the year but they could be on the horizon if the narrative gathers some momentum. Shares have broken through resistance and are now at their highest levels since January. Back then, there were days when the stock ran up as much as 600% in a single session. So while there’s little to find attractive about them for the long term, maybe there’s an argument to be had for putting some fun money into them.

Getting Involved

That’s probably the name of the game for any of the stocks on this list and their peers. The experts have been out in force this week urging caution, and all three of these stocks feature high up in former fund manager Whitney Tilson’s “Short Term Bubble Basket” list.

Featured Article: What is Forex?

A quick look at any financial headlines this week makes it clear that there’s a buying frenzy kicking off in the world of meme stocks once again. They grabbed both Wall Street’s and Main Street’s attention for a couple of weeks in January as double and triple percentage daily moves became the norm but then they seemed to fade away almost as quickly as they appeared.

But as equity markets, in general, turn higher after a sluggish few months in the meantime, it looks like there’s a fresh fire being lit underneath stocks that have above average short interest. Here are three that are worth keeping a close eye on.

AMC Entertainment Holdings (NYSE: AMC)

With as much as a 500% pop in the past week, AMC is currently the hottest of them all. It has a ways to go before it can top the 800% rally it posted in January, but what’s interesting here is that the share price is already three times higher than that previous high.

There’s an argument to be made that as we approach a complete economic reopening and recovery that the likes of AMC and their cinema business stand to do very well, but that certainly can’t claim all the glory for this most recent run. The stock’s short interest has kept it at the forefront of the minds of retail traders, many of whom crowd source their buying strategies on online forums.