Are Rising Bond Rates Bad News for Stocks?

Why have bond rates risen ever since the Fed said they would could rates? And what does that mean for the S&P 500 (SPY) after making recent highs? Answering those…

This story originally appeared on StockNews

Why have bond rates risen ever since the Fed said they would could rates? And what does that mean for the S&P 500 (SPY) after making recent highs? Answering those 2 questions will be at the heart of Steve Reitmeister latest market commentary. Read on for more.

Rising stock prices is a magical eraser that removes a lot of worry for investors. However, it must be a curiosity to a lot of you how the Fed could start rate cuts and yet bond yields have moved higher…actually quite a bit higher.

We will dive into this oddity today along with what it means for the market outlook and my year end S&P 500 (SPY) target.

Market Outlook

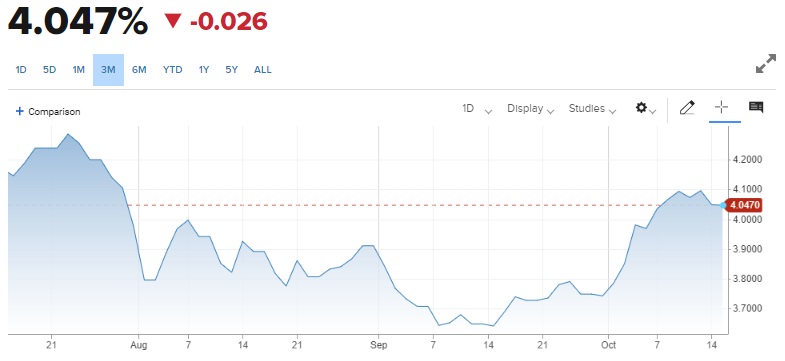

Let’s begin with this vital data point. The average 10 Year Treasury yield going back 4 decades is 3.87%.

If we went back further to include the hyper inflation days of the early 1980’s it would be much higher. It would also be much higher if we removed the artificially low rates Bernanke’s Fed produced to put an end to the Great Recession and revive the economy. However, it is fair to say that about 4% is the long term average for the 10 Year Treasury.

So, without a deeper dive the 4.05% yield today is pretty much on par with the long term average and thus not a serious cause for concern.

Now let’s go a step further.

Why did rates fall to 3.6% into the Fed rate cut announcement…then the Fed tell us that 1.5% of additional cuts will likely be on the way by the end of 2025…and yet rates have spiked since then???

OK. It could simply be said “buy the rumor, sell the news“.

Or simply that the Treasury yield is simply returning to the historical average near 4%.

OR…it could be noted that recent inflation data has not been good and thus the pace of future rate cuts may be a lot slower than advertised.

Going back to Friday October 4th job gains were larger than expected. With that Average Hourly Earnings (aka Wage Inflation) increased to 4% when a drop to 3.8% year over year was expected. Meaning this sticky form of inflation is not fading away as it should be.

This was later corroborated in the 10/10 CPI report where Core Inflation increased to 3.3% year over year. Another sticky form of inflation (housing/shelter) was also not easing as much as hoped for.

It did not help that on the next day the core reading for PPI rose from 2.6% to 2.8% year over year. Remember that PPI is the forward looking indicator of what shows up in CPI down the road.

Oddly investors took in all this rising inflation data and still believe that rates will be cut another 25 points at the next Fed meeting on 11/7. In fact, right now the odds point to 91.6% chance.

Put me in the 8.4% who see no rate forthcoming in November.

The Fed are patient and slow moving academics who base each decision on the facts in hand. With the labor market strong…they don’t need to cut rates to support that part of their dual mission.

Instead, they will likely focus on the “stable prices” part of the mission and notice quite clearly that recent data is not moving towards 2% as intended. So they will likely keep rates unchanged in the hopes that it will further slow demand and get inflation moving lower once again.

Reity, does this change your stock market outlook?

Not really. Things are still pretty well on track with the ideas shared in my recent 2025 Stock Market Outlook.

The target of hitting 6,000 before the year ends is too tempting not to reach after the election is finalized plus the seasonal benefit of the Santa Claus rally.

However, after that I suspect a fairly lackluster year for the S&P 500 in 2025. This fits in with historical trends that year 3 of a bull market is often around 0%.

And fits in with the fact that the PE for large caps, especially mega caps, are fully valued by any reasonable standard (PE of 22 and 30 respectively when long term average is 18).

Gladly there is plenty of room to catch up in the small and mid cap space where the forward looking PE is only 15-16. Add in 4 years of underperformance for the group and 2025 should be their time to shine.

That is why I am leaning in heavily with these smaller stocks in the Reitmeister Total Return portfolio. It has led to strong results this year…especially of late. And fully expect our lead over the market to increase in the year ahead.

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.21 (-0.04%) in after-hours trading Tuesday. Year-to-date, SPY has gained 23.13%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Are Rising Bond Rates Bad News for Stocks? appeared first on StockNews.com

Why have bond rates risen ever since the Fed said they would could rates? And what does that mean for the S&P 500 (SPY) after making recent highs? Answering those 2 questions will be at the heart of Steve Reitmeister latest market commentary. Read on for more.

Rising stock prices is a magical eraser that removes a lot of worry for investors. However, it must be a curiosity to a lot of you how the Fed could start rate cuts and yet bond yields have moved higher…actually quite a bit higher.

We will dive into this oddity today along with what it means for the market outlook and my year end S&P 500 (SPY) target.