Bear Market Rally…or Oversold Bounce?

The S&P 500 (SPY) is up more than 10% over the last 2 weeks, and it’s confirmation that this is more of a ‘bear market rally’ rather than an oversold…

This story originally appeared on StockNews

The S&P 500 (SPY) is up more than 10% over the last 2 weeks, and it’s confirmation that this is more of a “bear market rally’ rather than an oversold bounce. That being said, this rally will likely roll over to new lows as the financial and economic conditions continue to deteriorate. These developments and why the current rally is destined to fail are the major topics of today’s commentary. Read on below to find out more….

(Please enjoy this updated version of my weekly commentary published October 31st, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

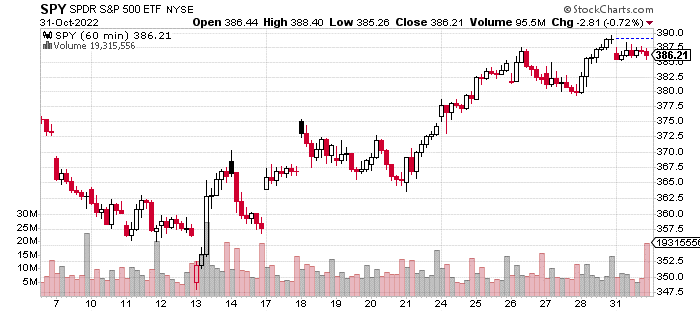

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is up by a bit more than 2.1%, extending the previous week’s 5.5% advance.

Q3 earnings season has continued to do better than expected albeit not great from an absolute perspective.

Overall, Q3 earnings are estimated to increase by 2.2%. This would be negative if we strip out the energy sector. Relative to the start of earnings season, it’s an improvement.

But a few months ago, analysts were estimating about 9% earnings growth.

However, the stock market’s reaction makes clear that this was priced in, and some were expecting worse.

Earnings season also has been an inverse of what we’ve seen for much of the past decade when the earnings growth of the “FANG’ stocks + Microsoft dominated and lifted mediocre results from other companies.

Now, the tech stocks are seeing earnings flatten or contract, while the rest of the market is seeing better prospects.

This isn’t totally surprising given the dynamic of a robust real economy vs a financial economy that is mired in a recession due to higher short-term rates.

It’s also an inverse of the previous decade when the financial economy thrived, while the real economy stagnated.

That was about weak aggregate demand and excess capacity. Today, we have strong demand but constraints in capacity leading to inflation.

The short-term solution is to contain inflation by eroding demand through higher rates…

Of course, the long-term solution is to increase the productive capacity of the economy by investing in infrastructure, human capital, and worthy endeavors.

For markets, the path is dependent on variables like inflation and the economy. As we’ve discussed before, it’s a matter of what breaks first – the economy or inflation.

This will determine whether we have a recession (or something worse) or a “soft landing’.

But, I think either outcome will be disappointing for investors. Let me explain why…

How the Rally Will End

Think of like the Fed’s rate hikes like chemotherapy that kills the cancer (inflation) but also hurts the patient (economy). If the patient is too weak, then the chemo has to be stopped.

Of course, the stock market (SPY) is more directly and negatively impacted by higher rates. And, rates will remain high the longer that the economy and inflation stay resilient.

I don’t think we are anywhere close to seeing the type of economic pain that would cause the Fed to pivot.

Nor do we have any material slowdown in inflation as the benefits of lower commodity prices and easing in supply chain pressures have been more than offset by increases in “stickier’ factors like rents and wages.

Until this dynamic changes, there is no reason to believe the bear market is close to ending. And in fact, any bout of market or economic strength is likely to lead to an aggressively hawkish Fed for longer.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $384.48 per share on Tuesday morning, down $1.73 (-0.45%). Year-to-date, SPY has declined -18.11%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Bear Market Rally…or Oversold Bounce? appeared first on StockNews.com

The S&P 500 (SPY) is up more than 10% over the last 2 weeks, and it’s confirmation that this is more of a “bear market rally’ rather than an oversold bounce. That being said, this rally will likely roll over to new lows as the financial and economic conditions continue to deteriorate. These developments and why the current rally is destined to fail are the major topics of today’s commentary. Read on below to find out more….

(Please enjoy this updated version of my weekly commentary published October 31st, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…