PayPal Stock is Still Ready for Bargain Hunting

Digital payments platform PayPal, Inc. (NASDAQ: PYPL) shares have recently staged a rebound with the benchmark indexes but may be losing steam again.

This story originally appeared on MarketBeat

Digital payments platform PayPal, Inc. (NASDAQ: PYPL) shares have recently staged a rebound with the benchmark indexes but may be losing steam again. Both top and bottom-line growth is slowing as evidenced by its Q4 2021 earnings results. This combined with the market sell-off created a perfect storm of headwinds plunging shares to 52-week lows of $92.25 on March 8, 2022, before rallying nearly 30%. The Company has left Russia shuttering cross border transactions because of the Ukraine invasion. It’s exit from eBay (NASDAQ: EBAY) has clearly had an impact on growth, but top line is still growing 22% ex-eBay with 32% growth expected in the fiscal Q2 2022 quarter. Rising inflation impacted the lower income levels of its 425 million customer base. Supply chain shortages impacted small businesses. However, the Company expects these transitory headwinds to dissipate as well as the ex-eBay pressures in the second half for 2022. Prudent investors seeking exposure in a top e-commerce player can watch for opportunistic pullbacks in shares of PayPal.

Q4 2021 Earnings Report

PayPal reported its Q4 2021 earnings for the quarter ended December 2021 on Feb. 1, 2021. The Company reported earnings-per-share (EPS) profits of $1.11 versus consensus analyst estimates for $1.12, missing by (-$0.01). Revenues grew 13.1% year-over-year (YoY) to $6.92 billion beating $6.89 billion consensus analyst estimates. The Company added 49 million net new active accounts for a total of 426 million active accounts with a record 5.33 billion transactions for the quarter. Transactions per active account rose 11% to 45 as the Company generated $5.4 billion in annual free cash flow.

Morgan Stanley Technology, Media, and Telecom Conference 2022

On March 8, 2022, PayPal CEO Dan Schulman presented at the Morgan Stanley Technology Conference. He noted that PayPal has a less than a half percent exposure to Russia and the Ukraine. The Company had already decided to leave the domestic market in Russia years ago and has suspended cross-border services. He proceeded to answer questions presented by Morgan Stanley analyst James Faucette. CEO Schulman commented there are three lasting secular tailwinds as a result of the pandemic driven ramp up. E-commerce is the first secular tailwind. Retailers are focused on commerce from all channels with the digital space being a top focus. They are constantly trying to finds ways to connect with consumers digitally through new spaces. Secondly, digital payments growing worldwide. Less cash and more digital for faster payments. Even central banks are having discussions with the Company regarding central bank-issued digital currencies. Third, the growth of digital wallets and checkout is a quickly expanding tailwind. He stated that these three tailwinds are lasting trends regardless of specific segments. However, he did admit shortfalls, “So it’s been difficult to predict. We clearly got a little bit ahead of ourselves in looking at what was happening early on, in the pandemic, but if you look at the underlying strength of our business, yeah, look at fourth quarter, I think ex-eBay, our growth was 22%. You look at year over two year, in fourth quarter, ex-eBay, our growth was 25%. So we’ve a really strong underlying growth. We have a number of things that we’re lapping, eBay, and our highest growth quarters. But everything I see right now, points to good strength in the core business.”

Life After eBay

CEO Shulman admitted the switch to its own managed payments put about $1.4 billion in incremental pressure in 2021. That should dissipate after the $600 million in incremental pressures in 1H 2022. He looks forward to lapping eBay pressures and finally be able to illustrate the strong growth ex-eBay moving forward. He expects 32% growth in Q2 2022 ex-eBay thanks to many initiatives to drive growth ranging from its Buy Now Pay Later (BNPL) to digital wallet and launch of crypto.

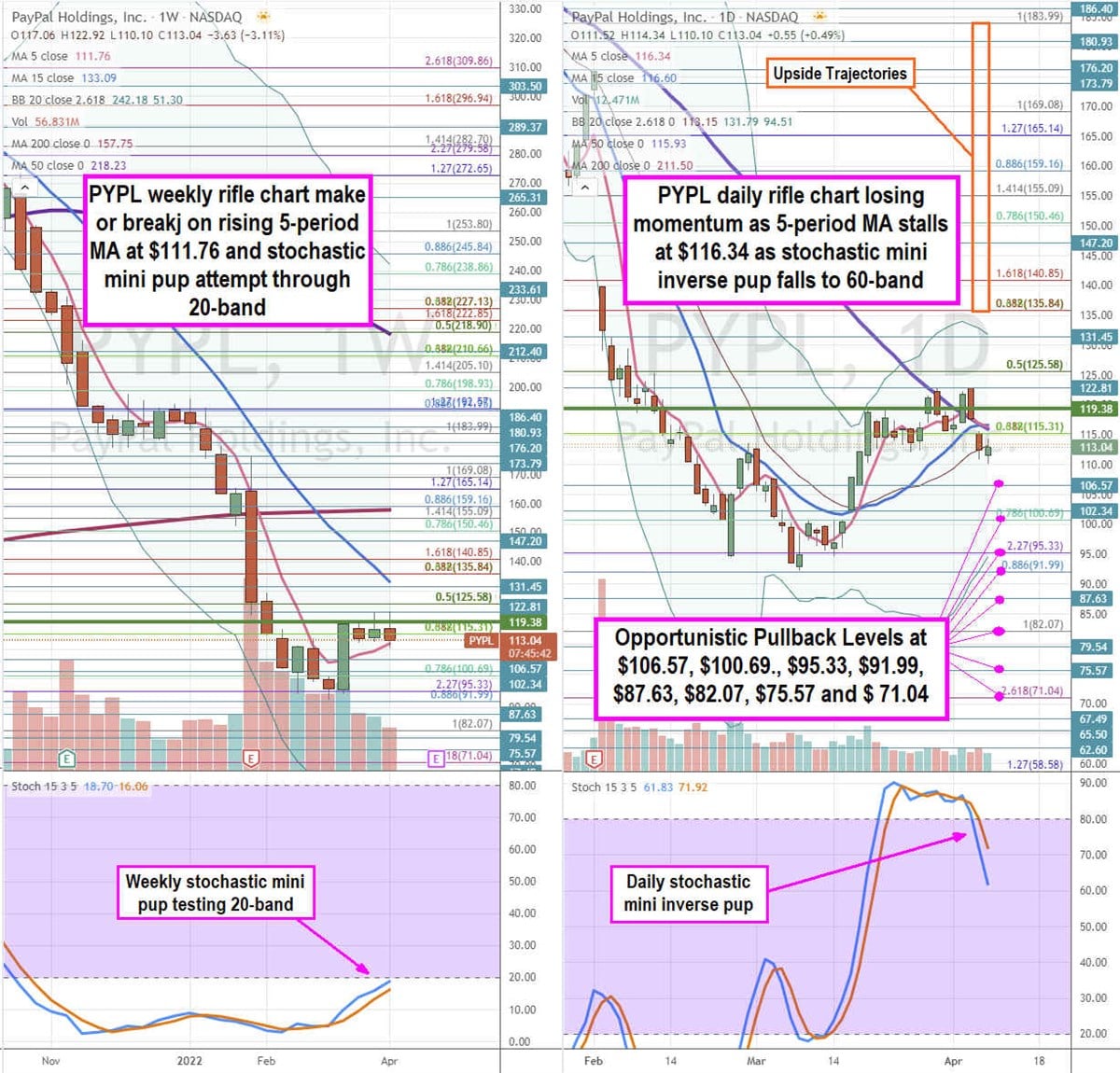

PYPL Price Trajectories

Using the rifle charts on a weekly and daily time frame provides a precision view of the landscape for PYPL stock. The weekly rifle chart bottomed out near the $91.99 Fibonacci (fib) level. The weekly market structure low (MSL) buy triggers on a breakout through the $119.38. The weekly rifle chart downtrend is stalling as the 5-period moving average (MA) rises at $111.76 towards the 15-period MA at $133.09 for a channel tightening powered by the weekly stochastic attempting to mini pup at the 20-band. The weekly 200-period MA resistance sits at $157.75. The daily rifle chart has very tight MAs with the daily 50-period MA overlapping at $115.93 with the 5-period MA at $116.34 and the 15-period MA at $116.60 all acting as immediate resistances as the daily stochastic mini inverse pup works its oscillation down towards the 60-band. The daily upper Bollinger Bands (BBs) sit at $131.79 and lower BBs at $94.51. Prudent investors can look for opportunistic pullback entry levels at the $106.57, $100.69 fib, $95.33 fib, $91.99 fib, $87.63, $82.07 fib, $75.57, and the $71.04 fib level. Upside trajectories range from the $135.84 fib level up towards the $183.99 fib level.

Digital payments platform PayPal, Inc. (NASDAQ: PYPL) shares have recently staged a rebound with the benchmark indexes but may be losing steam again. Both top and bottom-line growth is slowing as evidenced by its Q4 2021 earnings results. This combined with the market sell-off created a perfect storm of headwinds plunging shares to 52-week lows of $92.25 on March 8, 2022, before rallying nearly 30%. The Company has left Russia shuttering cross border transactions because of the Ukraine invasion. It’s exit from eBay (NASDAQ: EBAY) has clearly had an impact on growth, but top line is still growing 22% ex-eBay with 32% growth expected in the fiscal Q2 2022 quarter. Rising inflation impacted the lower income levels of its 425 million customer base. Supply chain shortages impacted small businesses. However, the Company expects these transitory headwinds to dissipate as well as the ex-eBay pressures in the second half for 2022. Prudent investors seeking exposure in a top e-commerce player can watch for opportunistic pullbacks in shares of PayPal.

Q4 2021 Earnings Report

PayPal reported its Q4 2021 earnings for the quarter ended December 2021 on Feb. 1, 2021. The Company reported earnings-per-share (EPS) profits of $1.11 versus consensus analyst estimates for $1.12, missing by (-$0.01). Revenues grew 13.1% year-over-year (YoY) to $6.92 billion beating $6.89 billion consensus analyst estimates. The Company added 49 million net new active accounts for a total of 426 million active accounts with a record 5.33 billion transactions for the quarter. Transactions per active account rose 11% to 45 as the Company generated $5.4 billion in annual free cash flow.