The Mattel Train is Ready to Leave the Station

Global toy manufacturer Mattel (NYSE: MAT) stock is trading up 5% on the year. The maker of blue chip brands like Barbie, Hot Wheels, Fisher Price

This story originally appeared on MarketBeat

Global toy manufacturer Mattel, Inc. (NYSE: MAT) stock is trading up 5% on the year. The maker of blue chip brands like Barbie, Hot Wheels, Fisher Price, and American Girls is still delivering double digit growth despite inflationary pressures and supply chain costs. In fact, Mattel has been profitable throughout every bear market and recession until Toys-R-Us went bankrupt in 2018. From 2018 to 2021, the new CEO Ynon Kreiz spearheaded a bold turnaround plan consisting of cost cutting initiatives and aggressively monetizing its portfolio of iconic IPs. The Company reported its eighth straight quarter of sequential revenue growth ahead of the upcoming holiday season. Mattel was able to raise prices to mitigate higher expenses while growing out its timeless IP franchises in an omnichannel model. CEO Kreiz’s background in content production helped transform Mattel into a global entertainment enterprise. The Company has successfully executed its turnaround plan through the pandemic to emerge as an entertainment brand. Mattel is doing much better than rival Hasbro (NYSE: HAS) winning global licenses from Disney (NYSE: DIS) and Universal Pictures (NASDAQ: COMCSA), while Hasbro loses its CEO. Shares have remained steady despite recession fears in 2022. In fact, a tightening trading channel suggests the stock may be setting up for a breakout to prior highs.

Iconic and Still Growing

On July 21, 2022, Mattel released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profits of $0.18 beating analyst estimates for a profit of $0.06, by $0.12. Revenues rose 20.5% year-over-year (YoY) to $1.24 billion, beating analyst estimates for $1.1 billion. Adjusted gross margin was 44.4%, down (-260 bps) due to inflationary pressures, increased royalty expense, and supply chain expenses. North America net sales grew 30%.

IP Monetization Driving Growth

Mattel CEO Ynon Kreiz commented, “The first half of the year was an outstanding period of growth for the company. We are benefiting from strong retail partnerships and look forward to meeting the projected increase in consumer demand for our product, as we enter the second half of the year and the all-important holiday season. As the owner of one of the strongest portfolios of children’s and family entertainment franchises in the world, we are excited by the opportunities to capture the full value of our IP.”

Conservative In-Line Expectations

The Company issued in-line guidance for full-year 2022 with EPS coming in between $1.42 to $1.48 versus $1.48 consensus analyst estimates. Net sales are expected to growth 8% to 10% with adjusted gross margins of 47% to 48%. Adjusted EBITDA is expected between $1.10 billion to $1.125. For 2023, Mattel expects high single digit net sales growth and adjust EPS to exceed $1.90 versus $1.95 consensus analyst estimates. The market’s tepid reaction may suggest the bar is being purposely set low.

The Train Leaves the Station Before 2023

Mattel is scheduled to release the J.J. Abrams produced Barbie movie starring Margot Robbie in summer 2023. The movie is being co-produced with Warner Media (NYSE: WBD) which helps lessen the financial risk for the Mattel if it flops. If successful, then a Hot Wheels movie will be green lit for production with J.J. Abrams. Further productions could include its other hot IPs including Monster High, Masters of the Universe, Polly Pocket, and Barney. Toy spending has not receded despite recession fears.

Attractive Pullback Levels

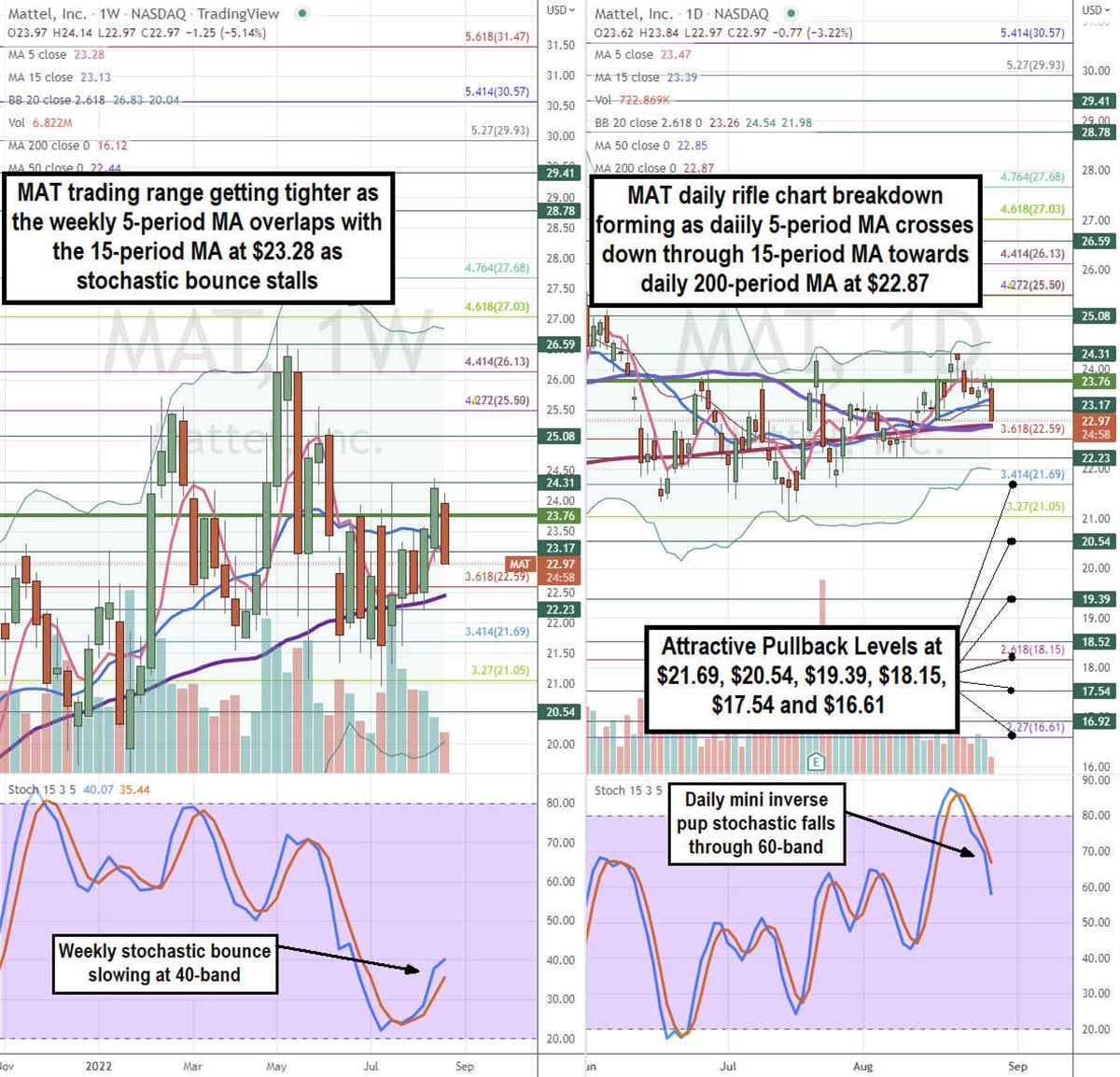

Using the rifle charts on a weekly and daily time frames provides a precision view of the landscape for MAT stock. The weekly rifle chart made its most recent bottom near the $21.69 Fibonacci (fib) level. Shares spiked on the earnings release to trigger a breakout on the weekly market structure low (MSL) buy trigger above $23.76. The weekly 5-period moving average (MA) support is starting to rise at $23.47 followed by the 15-period MA at $23.32. The weekly upper Bollinger Bands (BBs) touched at $26.94. The weekly stochastic crossed back up on a mini inverse pup attempt as it coils through the 60-band. The weekly 50-period MA is rising near the $21.69 fib. The daily rifle chart uptrend is rising at $26.06 followed by the 15-period MA at $24.04. The daily upper BBs sit at $19.43 as the stochastic mini pup drives through the 90-band. The daily 50-period MA support sits at $23.50, and the daily 200-period MA sits at $21.88. Prudent investors can watch for opportunistic pullbacks levels at the $24.74 fib, $23.76 weekly MSL trigger, $22.59 fib, $21.69 fib, $21.05 fib, $20.29, $19.01 fib, and the $18.15 fib level. Upside trajectories range from the $30.57 fib up towards the $35.60 price level.

Global toy manufacturer Mattel, Inc. (NYSE: MAT) stock is trading up 5% on the year. The maker of blue chip brands like Barbie, Hot Wheels, Fisher Price, and American Girls is still delivering double digit growth despite inflationary pressures and supply chain costs. In fact, Mattel has been profitable throughout every bear market and recession until Toys-R-Us went bankrupt in 2018. From 2018 to 2021, the new CEO Ynon Kreiz spearheaded a bold turnaround plan consisting of cost cutting initiatives and aggressively monetizing its portfolio of iconic IPs. The Company reported its eighth straight quarter of sequential revenue growth ahead of the upcoming holiday season. Mattel was able to raise prices to mitigate higher expenses while growing out its timeless IP franchises in an omnichannel model. CEO Kreiz’s background in content production helped transform Mattel into a global entertainment enterprise. The Company has successfully executed its turnaround plan through the pandemic to emerge as an entertainment brand. Mattel is doing much better than rival Hasbro (NYSE: HAS) winning global licenses from Disney (NYSE: DIS) and Universal Pictures (NASDAQ: COMCSA), while Hasbro loses its CEO. Shares have remained steady despite recession fears in 2022. In fact, a tightening trading channel suggests the stock may be setting up for a breakout to prior highs.

Iconic and Still Growing

On July 21, 2022, Mattel released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profits of $0.18 beating analyst estimates for a profit of $0.06, by $0.12. Revenues rose 20.5% year-over-year (YoY) to $1.24 billion, beating analyst estimates for $1.1 billion. Adjusted gross margin was 44.4%, down (-260 bps) due to inflationary pressures, increased royalty expense, and supply chain expenses. North America net sales grew 30%.

IP Monetization Driving Growth

Mattel CEO Ynon Kreiz commented, “The first half of the year was an outstanding period of growth for the company. We are benefiting from strong retail partnerships and look forward to meeting the projected increase in consumer demand for our product, as we enter the second half of the year and the all-important holiday season. As the owner of one of the strongest portfolios of children’s and family entertainment franchises in the world, we are excited by the opportunities to capture the full value of our IP.”