PACCAR proves commercial truck sales are firing on all cylinders

PACCAR Inc. (NASDAQ: PCAR) designs and manufactures light, medium, and heavy-duty commercial trucks under Peterbilt, DAF, and Kenworth brands.

This story originally appeared on MarketBeat

PACCAR Inc. (NASDAQ: PCAR) designs and manufactures light, medium, and heavy-duty commercial trucks under Peterbilt, DAF, and Kenworth brands. This Auto/Tires/Trucks sector company operates with three divisions comprised of Truck, Parts and Financial Services. The business has been booming as the company hit record deliveries, revenues, and net income in 2023.

PACCAR completed its 85th year of consecutive net income, delivering 204,200 vehicles worldwide. The company also announced a joint venture with Cummins Inc. (NYSE: CMI), Daimler Truck Holding AG (OTCMKTS: DTRUY) and EVE Energy to manufacture commercial vehicle batteries in the United States.

Global truck markets

PACCAR sold 297,000 Class 8 truck units in 2023 and expects to sell 260,000 to 300,000 trucks in 2024. Above 16-tonne truck registrations are expected to be between 260,00 and 300,000. The company credits infrastructure spending and the replacement of older fleets as the key drivers of demand for Peterbilt and Kenworth trucks. DAF’s 2023 European deliveries rose to a record 63,000 trucks. DAF grew its market share to 10.2%, up from 6.9% in Brazil last year. The production of the new Peterbilt Model 589 commenced in January 2024. A new electric truck assembly plant was opened by DAF, earning it the Green Truck award, deeming it the most fuel-efficient truck in Europe.

Parts and Distribution

PACCAR’s parts distribution centers (PDCs) support over 2,000 sales, parts and service locations for Peterbilt and Kenworth dealers and 300 TRP stores. PACCAR has started construction of its new 240,000-square-foot PDC, which is expected to open in Massbach, Germany, in 2024. The company has 18 worldwide PDCs totaling over 3.3 million square feet. Full-year 2023 truck parts and other gross margins were 19.3%. Check out the sector heatmap on MarketBeat.

Firing on all cylinders in Q4 2023

On Jan. 23, 2024, PACCAR reported Q4 2024 EPS of $2.70, beating consensus analyst estimates by 49 cents. Net income grew 54% YoY to $1.42 billion, which included a $120 million tax provision release in Brazil. Revenues grew 11.08% YoY to $9.08 billion, beating analyst estimates by $294.27 million.

PACCAR Parts generated $1.61 billion in revenues and a pre-tax income of $432.4 million. PACCAR Financial Services (PFS) generated $484.4 million in Q4 2023 revenues and $113 million in pre-tax net income. PFS has a portfolio of 233,000 trucks and trailers totaling $20.96 billion in assets, which includes its full-service truck leasing company PacLease, with a fleet of 44,000 vehicles.

Full-year 2023 financial metrics

PACCAR generated record 2023 revenues of $35.13 billion with a record net income of $4.60 billion. After-tax return on revenues was 13.1%. PACCAR Parts revenues for to $6.41 billion with a pre-tax net income of $1.70 billion. PACCAR Financial Services assets were $20.96 billion, generating pre-tax income of $540.3 million. Cash provided by operations was $4.19 billion. The company declared record dividends of $2.23 billion. The company invested $1.11 billion in capital projects and research and development. Get AI-powered insights on MarketBeat.

Las Vegas Consumer Electronics Show 2024

PACCAR unveiled several advanced products and technologies at the Las Vegas Consumer Electronics Show (CES) in January 2024. some of the products on display were the Kenworth T680 full cell electric vehicles (FCEV), the Peterbilt SuperTruck II, and a DAF XD battery electric truck along with PACCAR electric vehicles (EV) charging solutions.

PACCAR Executive Vice-President Mike Dozier commented, “PACCAR’s industry-leading battery electric and hydrogen fuel cell electric vehicles help customers operate with reduced emissions and outstanding efficiency.”

PACCAR analyst ratings and price targets are at MarketBeat. PACCAR peers and competitor stocks can be found with the MarketBeat stock screener.

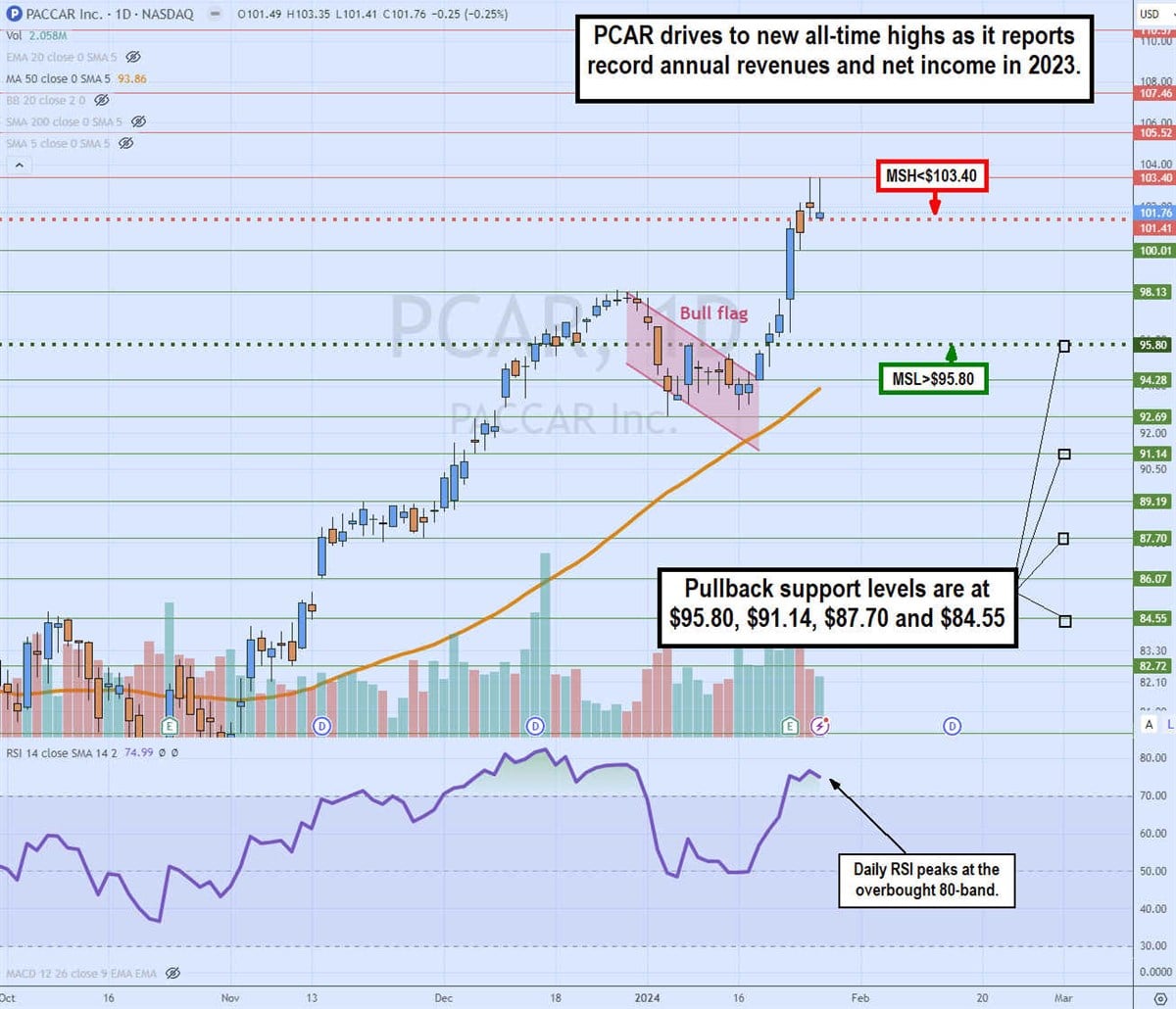

Daily bull flag breakout

The daily candlestick chart on PCAR illustrates a bull flag breakout pattern. The flagpole formed on the sharp rally from the $78.06 hammer candlestick low on Nov. 1, 2023, up to the peak at $98.13 on Dec. 28, 2023. Shares pulled back, forming the bull flag with lower highs and lower lows, falling towards the daily 50-period moving average support now at $93.86.

The bull flag breakout triggered the daily market structure low (MSL) breakout through the $95.80 trigger on Jan. 19, 2024. Shares surged to a high of $103.40 on Jan. 25, 2024, forming a daily market structure high (MSH) sell trigger under $101.41. Pullback support levels are at $95.80, $91.14, $87.70 and $84.55.

PACCAR Inc. (NASDAQ: PCAR) designs and manufactures light, medium, and heavy-duty commercial trucks under Peterbilt, DAF, and Kenworth brands. This Auto/Tires/Trucks sector company operates with three divisions comprised of Truck, Parts and Financial Services. The business has been booming as the company hit record deliveries, revenues, and net income in 2023.

PACCAR completed its 85th year of consecutive net income, delivering 204,200 vehicles worldwide. The company also announced a joint venture with Cummins Inc. (NYSE: CMI), Daimler Truck Holding AG (OTCMKTS: DTRUY) and EVE Energy to manufacture commercial vehicle batteries in the United States.