Does Goldman Sachs Group Stock Deserve a Place in Your Portfolio?

The shares of leading investment banking firm Goldman Sachs Group (GS) have plummeted nearly 20% in price this year amid investor fears of heightened default risk due to the war…

This story originally appeared on StockNews

The shares of leading investment banking firm Goldman Sachs Group (GS) have plummeted nearly 20% in price this year amid investor fears of heightened default risk due to the war in Ukraine and U.S. regulators’ crackdown on the SPAC market. So, is GS a smart investment now? Keep reading to learn our view.

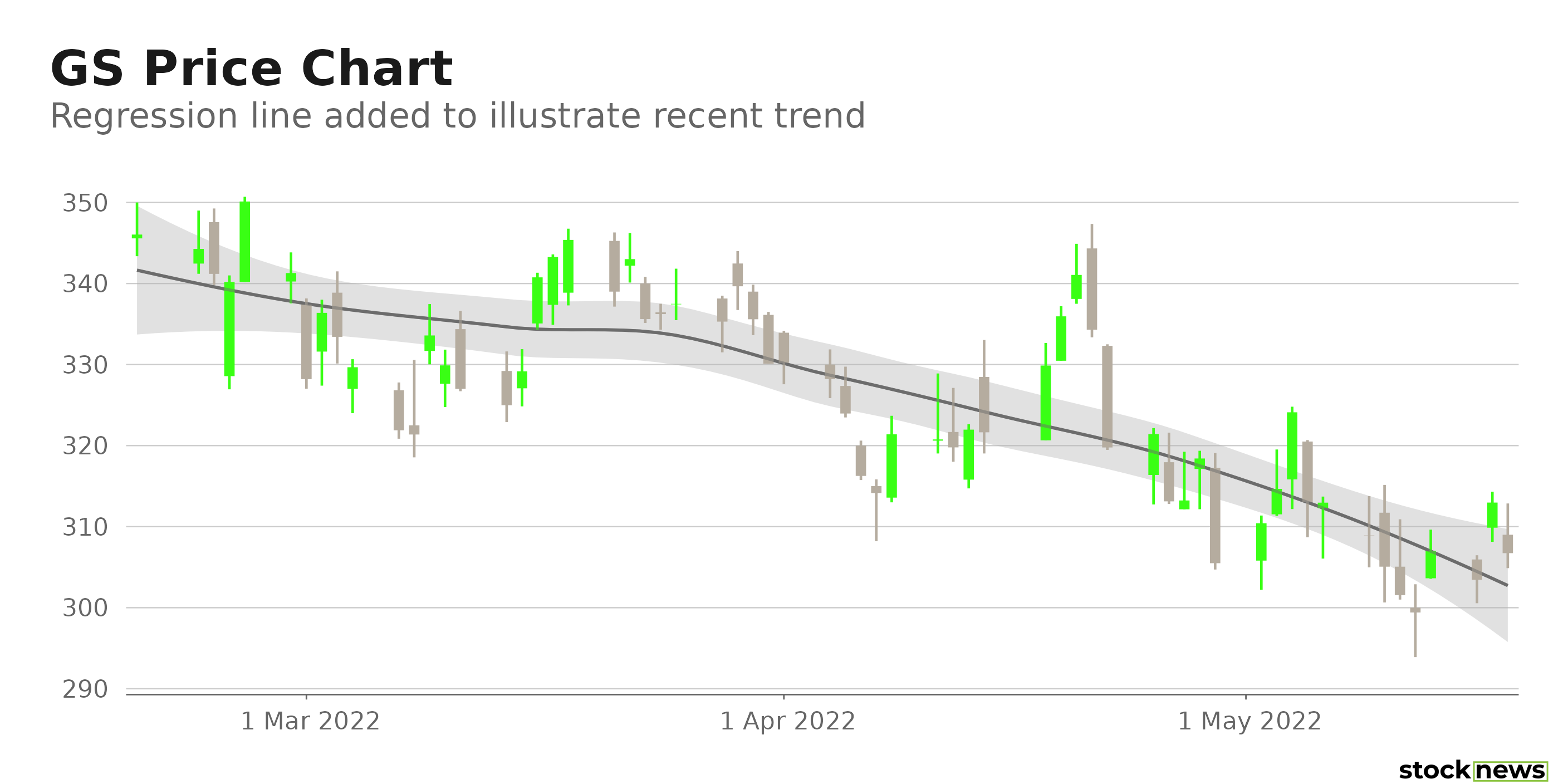

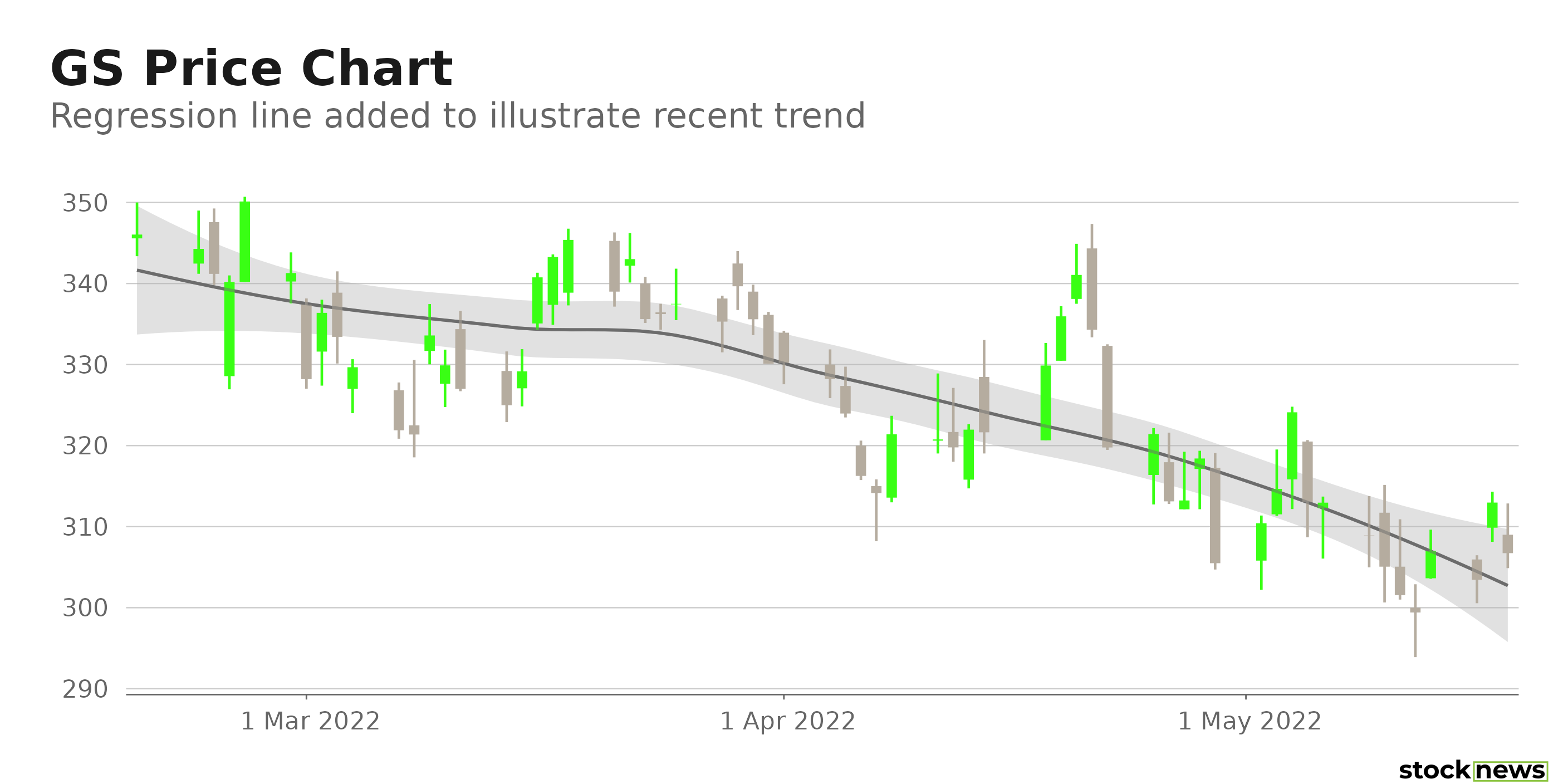

U.S. banking giant Goldman Sachs Group, Inc. (GS) provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through four segments: Investment Banking; Global Markets; Asset Management; and Consumer & Wealth Management. GS’ shares have slumped 15.9% in price over the past year and 19.8% year-to-date to close yesterday’s trading session at $306.73.

Wall Street expects a greater risk of default by major banks, with worsening credit risk since the Russian invasion of Ukraine. The cost to insure bonds from these banks against default hit two-year highs earlier this month amid heightened worries about the Fed’s aggressive moves to tame inflation and the possibility of a recession. GS slashed its total credit exposure to Russia and said that market exposure tied to Russia and total exposure to Ukraine were not material. It was the first major U.S. bank to announce a retreat from Russia after the country invaded Ukraine. GS also noted that the war has so far resulted in a net loss of $300 million for the bank in the first quarter. The invasion has hampered the mainstay businesses of some big U.S. banks.

In addition, GS has announced that it will reduce its involvement with blank-check companies as U.S. regulators continue to clamp down on what was one of the hottest trends on Wall Street in recent years. The thriving special purpose acquisition company (SPAC) market had benefited the bank greatly, but the tightening scrutiny and the uncertainty over the war are adding to its woes.

Here is what could shape GS’ performance in the near term:

Declining Financials

For its fiscal first quarter, ended March 31, 2022, GS’ total net revenues declined 26.9% year-over-year to $12.93 billion. Also, its investment banking revenues decreased 40.2% from itsyear-ago value to $2.13 billion. Its net earnings came in at $3.94 billion, down 42.4% from the prior-year quarter. The company’s EPS declined 42.2% year-over-year to $10.76.

“It was a turbulent quarter dominated by the devastating invasion of Ukraine,” CEO David Solomon said. “The rapidly evolving market environment had a significant effect on client activity as risk intermediation came to the fore and equity issuance came to a near standstill,” he added.

Bleak Analysts Expectation

The Street expects the company’s revenues to come in at $11.95 billion in its fiscal second quarter, ending June 30, 2022, indicating a decline of 22.4% year-over-year. Also, its revenues are expected to decrease 12.4% in the following quarter, ending Sept. 30,2022, and 19.1% in its fiscal year ending Dec. 31, 2022. Furthermore, the $37.88 consensus EPS estimate indicates a 36.3% decline year-over-year. Its EPS is expected to decrease by 41.7% in the current quarter and 36.5% in the next quarter.

Mixed Profitability

The bank’s 88.20% gross profit margin is 34.8% higher than the 65.44% industry average, while its34.97% net income marginis 18.2% higher than the 29.59% industry average. Also, its 18.90% ROE is 48.5% higher than the 12.73% industry average.

However, its 1.18% ROAis 7.2% lower than the 1.27% industry average. And its 0.04% asset turnover ratio is 82.6% lower than the 0.21% industry average.

Discounted Valuation

In terms of forward P/E, GS is currently trading at 8.07x, which is 23.7% lower than the 10.57x industry average. Also, its 2.14 forward Price/Sales ratio is 26.4% lower than the 2.91 industry average , while its 1.01 Price/Book multiple is 9.7% lower than the 1.12 industry average.

POWR Ratings Reflect Uncertain Prospects

GS has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Quality, which is consistent with its mixed profitability.

GS has an F grade for Growth. Its weak performance in the last reported quarter and analysts’ expectation of a further decline in its top and bottom line justifies this grade.

Among the 24 stocks in the C-rated Investment Brokerage industry, GS is ranked #19.

Beyond what I have stated above, one can also view GS’ grades for Value, Sentiment, Momentum, and Stability here.

View the top-rated stocks in the Investment Brokerage industry here.

Bottom Line

The headwinds from the Russia-Ukraine and changing market environment have greatly hampered GS’ performance in the first quarter of 2022. Moreover, analysts are bearish about the bank’s near-term prospects. Thus, given the uncertainties ahead, I think it could be best to wait for a better entry point in the stock.

How Does Goldman Sachs Group, Inc. (GS) Stack Up Against its Peers?

While GS has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Manning & Napier, Inc. (MN), which has an A (Strong Buy) rating, and PJT Partners Inc. (PJT) and Evercore Inc. (EVR) which have a B (Buy) rating.

Want More Great Investing Ideas?

GS shares fell $4.73 (-1.54%) in premarket trading Thursday. Year-to-date, GS has declined -19.35%, versus a -17.24% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Does Goldman Sachs Group Stock Deserve a Place in Your Portfolio? appeared first on StockNews.com

The shares of leading investment banking firm Goldman Sachs Group (GS) have plummeted nearly 20% in price this year amid investor fears of heightened default risk due to the war in Ukraine and U.S. regulators’ crackdown on the SPAC market. So, is GS a smart investment now? Keep reading to learn our view.

U.S. banking giant Goldman Sachs Group, Inc. (GS) provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through four segments: Investment Banking; Global Markets; Asset Management; and Consumer & Wealth Management. GS’ shares have slumped 15.9% in price over the past year and 19.8% year-to-date to close yesterday’s trading session at $306.73.

Wall Street expects a greater risk of default by major banks, with worsening credit risk since the Russian invasion of Ukraine. The cost to insure bonds from these banks against default hit two-year highs earlier this month amid heightened worries about the Fed’s aggressive moves to tame inflation and the possibility of a recession. GS slashed its total credit exposure to Russia and said that market exposure tied to Russia and total exposure to Ukraine were not material. It was the first major U.S. bank to announce a retreat from Russia after the country invaded Ukraine. GS also noted that the war has so far resulted in a net loss of $300 million for the bank in the first quarter. The invasion has hampered the mainstay businesses of some big U.S. banks.

In addition, GS has announced that it will reduce its involvement with blank-check companies as U.S. regulators continue to clamp down on what was one of the hottest trends on Wall Street in recent years. The thriving special purpose acquisition company (SPAC) market had benefited the bank greatly, but the tightening scrutiny and the uncertainty over the war are adding to its woes.

Here is what could shape GS’ performance in the near term:

Declining Financials

For its fiscal first quarter, ended March 31, 2022, GS’ total net revenues declined 26.9% year-over-year to $12.93 billion. Also, its investment banking revenues decreased 40.2% from itsyear-ago value to $2.13 billion. Its net earnings came in at $3.94 billion, down 42.4% from the prior-year quarter. The company’s EPS declined 42.2% year-over-year to $10.76.

“It was a turbulent quarter dominated by the devastating invasion of Ukraine,” CEO David Solomon said. “The rapidly evolving market environment had a significant effect on client activity as risk intermediation came to the fore and equity issuance came to a near standstill,” he added.

Bleak Analysts Expectation

The Street expects the company’s revenues to come in at $11.95 billion in its fiscal second quarter, ending June 30, 2022, indicating a decline of 22.4% year-over-year. Also, its revenues are expected to decrease 12.4% in the following quarter, ending Sept. 30,2022, and 19.1% in its fiscal year ending Dec. 31, 2022. Furthermore, the $37.88 consensus EPS estimate indicates a 36.3% decline year-over-year. Its EPS is expected to decrease by 41.7% in the current quarter and 36.5% in the next quarter.

Mixed Profitability

The bank’s 88.20% gross profit margin is 34.8% higher than the 65.44% industry average, while its34.97% net income marginis 18.2% higher than the 29.59% industry average. Also, its 18.90% ROE is 48.5% higher than the 12.73% industry average.

However, its 1.18% ROAis 7.2% lower than the 1.27% industry average. And its 0.04% asset turnover ratio is 82.6% lower than the 0.21% industry average.

Discounted Valuation

In terms of forward P/E, GS is currently trading at 8.07x, which is 23.7% lower than the 10.57x industry average. Also, its 2.14 forward Price/Sales ratio is 26.4% lower than the 2.91 industry average , while its 1.01 Price/Book multiple is 9.7% lower than the 1.12 industry average.

POWR Ratings Reflect Uncertain Prospects

GS has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Quality, which is consistent with its mixed profitability.

GS has an F grade for Growth. Its weak performance in the last reported quarter and analysts’ expectation of a further decline in its top and bottom line justifies this grade.

Among the 24 stocks in the C-rated Investment Brokerage industry, GS is ranked #19.

Beyond what I have stated above, one can also view GS’ grades for Value, Sentiment, Momentum, and Stability here.

View the top-rated stocks in the Investment Brokerage industry here.

Bottom Line

The headwinds from the Russia-Ukraine and changing market environment have greatly hampered GS’ performance in the first quarter of 2022. Moreover, analysts are bearish about the bank’s near-term prospects. Thus, given the uncertainties ahead, I think it could be best to wait for a better entry point in the stock.

How Does Goldman Sachs Group, Inc. (GS) Stack Up Against its Peers?

While GS has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Manning & Napier, Inc. (MN), which has an A (Strong Buy) rating, and PJT Partners Inc. (PJT) and Evercore Inc. (EVR) which have a B (Buy) rating.

Want More Great Investing Ideas?

GS shares fell $4.73 (-1.54%) in premarket trading Thursday. Year-to-date, GS has declined -19.35%, versus a -17.24% rise in the benchmark S&P 500 index during the same period.