Salesforce Brings Artificial Intelligence to CRM With Einstein

The platform bakes deep learning, machine learning, predictive analytics and natural language processing across the Salesforce cloud.

This story originally appeared on PCMag

The near future of artificial intelligence (AI) won’t be defined by ushering in a race of sentient machines. While we’re inching closer to the goal of AI brain mapping, the next era of AI will be more about imbuing the software and applications we use every day with deep learning, machine learning, predictive analytics and natural language processing (NLP). Those capabilities will run under the surface, along with serving as tools upon which to build. It’s about making AI a given rather than a novelty.

Customer relationship management (CRM) giant Salesforce unveiled its plan for more accessible, natively integrated AI for businesses today with the announcement of Salesforce Einstein, its “AI for CRM” technology. Einstein will be deployed across the Salesforce cloud to analyze the mountain of automated data the platform collects — activity data, sales, email, e-commerce and calendar, social data streams and Internet of Things (IoT) data — and run machine learning and predictive analytics algorithms, NLP and what the company calls “smart data discovery” to offer data insights and recommendations across different business use cases within the platform. Many of the capabilities will also be offered as developer tools to build AI applications on Salesforce.

“Think of Einstein as the intelligence layer between the data and the actual apps,” said John Ball, Senior Vice President and General Manager of Content for Salesforce, during a press briefing. “The best AI is when the user doesn’t necessarily notice it. We surface lead and opportunity insights, and we’ve baked AI throughout the platform and the user experience so that, over time, the user won’t even think of it as an AI-powered feature; it’s just part of the platform.”

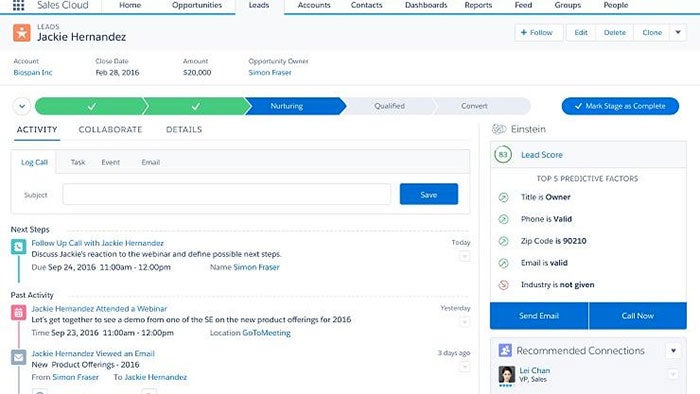

In the main Salesforce Sales Cloud, Einstein shows itself in a couple of ways. A feature called Predictive Lead Scoring, where a machine learning model analyzes industry and engagement data, is designed to help sales reps focus on the most promising lead.You can also use predictive scoring in other areas of the Salesforce Marketing Cloud, such as gauging prospective customer response to an email marketing campaign. In that scenario, Einstein could return results based on common customer behaviors and deliver advice like automated send-time optimization based on when subscribers have been historically most engaged. Another CRM AI feature called Opportunity Insights analyzes customer interactions such as inbound emails to alert sales reps to which way a deal is trending.

In Service Cloud, Einstein doing a lot of automated work around case classification and suggested responses. In the Commerce Cloud it’s doing e-commerce product recommendations and personalized predictive search, meaning product search results modeled off their individual profile.

On the question of customer privacy with all the data Einstein is analyzing, Ball avoided specifics but said Salesforce’s best practices around privacy and trust apply to Einstein.

“Trust is our number one value. Everything we do is trusted. Einstein is no difernent,” said Ball. “The entire process is automated. We’re automatically building these models, so no data scientists are looking at the data. It’s a machine learning process, so no data is being shared between customers.”

Einstein’s impact continues in the Salesforce Community Cloud where it provides computer vision analysis of images in the Social Studio. You’ll also find it in the Analytics Cloud where it delivers Predictive Wave Apps and automated analytics for folks using business process management (BPM). It also provides predictive scoring and automation for the Salesforce Internet of Things (IoT) Cloud. Ball described it like having a data scientist in every part of the platform.

“The whole reason we built Einstein is there aren’t enough data scientists in the world to go out and build predictive models for every company,” said Ball. “We’re democratizing AI so customers get the benefits without having to hire data scientists. The platform also enables developers at different skill levels to train their own classifiers with zero deep learning expertise.”

Related: How to Create a Facebook Messenger Chatbot For Free Without Coding

Where business apps meet deep learning

Another core aspect of Einstein is AI-powered app creation. Einstein will be available in the Salesforce App Cloud and Lightning App Builder as a set of tools that allow developers to train AI apps by using deep learning tools. Richard Socher, Chief Scientist at Salesforce, was on-hand during the briefing to discuss the new Salesforce Research Group, a team of data scientists and researchers focusing on deep learning, NLP and computer vision innovation. As with Google’s open-source TensorFlow toolkit, Socher explained how Einstein’s developer tools are aimed at making deep learning more accessible using the Predictive Vision image analysis in Social Studio as an example.

“You can train your image classifiers to do anything you want,” said Socher. “This is one of the first deep learning-based developer tools that will allow you to drag and drop inside an interface in Salesforce to make smart automated decision-making. It will allow you to do all sorts of new things, like go through millions of images and classify them to find your company logo or where your company is mentioned.”

Related: Top 10 Best Chatbot Platform Tools to Build Chatbots for Your Business

Salesforce will be giving a keynote on Einstein at its Dreamforce conference in early October, and will begin rolling out Einstein features across the Salesforce cloud in the company’s Winter ’17 release scheduled for October. Ball didn’t reveal much in the way of pricing for Einstein, only that “some capabilities will be bundled into existing editions and licenses, and others will require an extra charge.”

From a market perspective, Salesforce is essentially using AI techniques such as machine learning and predictive analytics the same way as Google, Facebook and others do for consumers, only for its vast quantities of sales and business data. Brandon Purcell, Senior Analyst at Forrester Research said an AI layer such as Einstein between its data and apps gives Salesforce an opportunity to leverage its business data on that same scale.

“In order for artificially intelligent systems to work, they need to be trained on massive amounts of data,” said Purcell. “In the B2C space, Google, Facebook, and Amazon have the most data on consumers. Einstein marks Salesforce’s ascendance to this top-tier, alone in the B2B space due to the incredible amount of data stored in their cloud.”

The near future of artificial intelligence (AI) won’t be defined by ushering in a race of sentient machines. While we’re inching closer to the goal of AI brain mapping, the next era of AI will be more about imbuing the software and applications we use every day with deep learning, machine learning, predictive analytics and natural language processing (NLP). Those capabilities will run under the surface, along with serving as tools upon which to build. It’s about making AI a given rather than a novelty.

Customer relationship management (CRM) giant Salesforce unveiled its plan for more accessible, natively integrated AI for businesses today with the announcement of Salesforce Einstein, its “AI for CRM” technology. Einstein will be deployed across the Salesforce cloud to analyze the mountain of automated data the platform collects — activity data, sales, email, e-commerce and calendar, social data streams and Internet of Things (IoT) data — and run machine learning and predictive analytics algorithms, NLP and what the company calls “smart data discovery” to offer data insights and recommendations across different business use cases within the platform. Many of the capabilities will also be offered as developer tools to build AI applications on Salesforce.

“Think of Einstein as the intelligence layer between the data and the actual apps,” said John Ball, Senior Vice President and General Manager of Content for Salesforce, during a press briefing. “The best AI is when the user doesn’t necessarily notice it. We surface lead and opportunity insights, and we’ve baked AI throughout the platform and the user experience so that, over time, the user won’t even think of it as an AI-powered feature; it’s just part of the platform.”